Payments from the American Rescue Plan’s one-year expansion of the Child Tax Credit (CTC) are due to start going out to tax filers in July. This expansion has the potential to dramatically reduce child poverty in California, but its impact depends on how many eligible families claim the credit with the IRS.

Monthly payments for the expanded CTC will total $250–$300 per child, depending on a child’s age. Unlike preexisting tax credits, payments for the expanded CTC are slated to be distributed monthly to provide a stable support for children, though families can opt out and receive their credit in a lump sum at tax time.

Using historical data, we find that child poverty in California drops by a third as a direct result of this expansion. Notably, the expansion extends eligibility to families with no earned income and makes families with very low incomes eligible for the full credit; families with undocumented adults remain eligible if they have children who are citizens or permanent residents. These features expand the CTC’s reach substantially compared to the federal Earned Income Tax Credit (EITC). (The CTC also includes families with higher earnings than the federal EITC, meaning the former is less targeted to low-income working families.)

However, families must file taxes or submit additional information to the IRS to obtain payments, and a sizable number of families are not required to file taxes. Research by the IRS and the US Census Bureau indicates that roughly a quarter of eligible Californians did not receive the federal EITC in recent years; this typically occurs because the family did not file taxes.

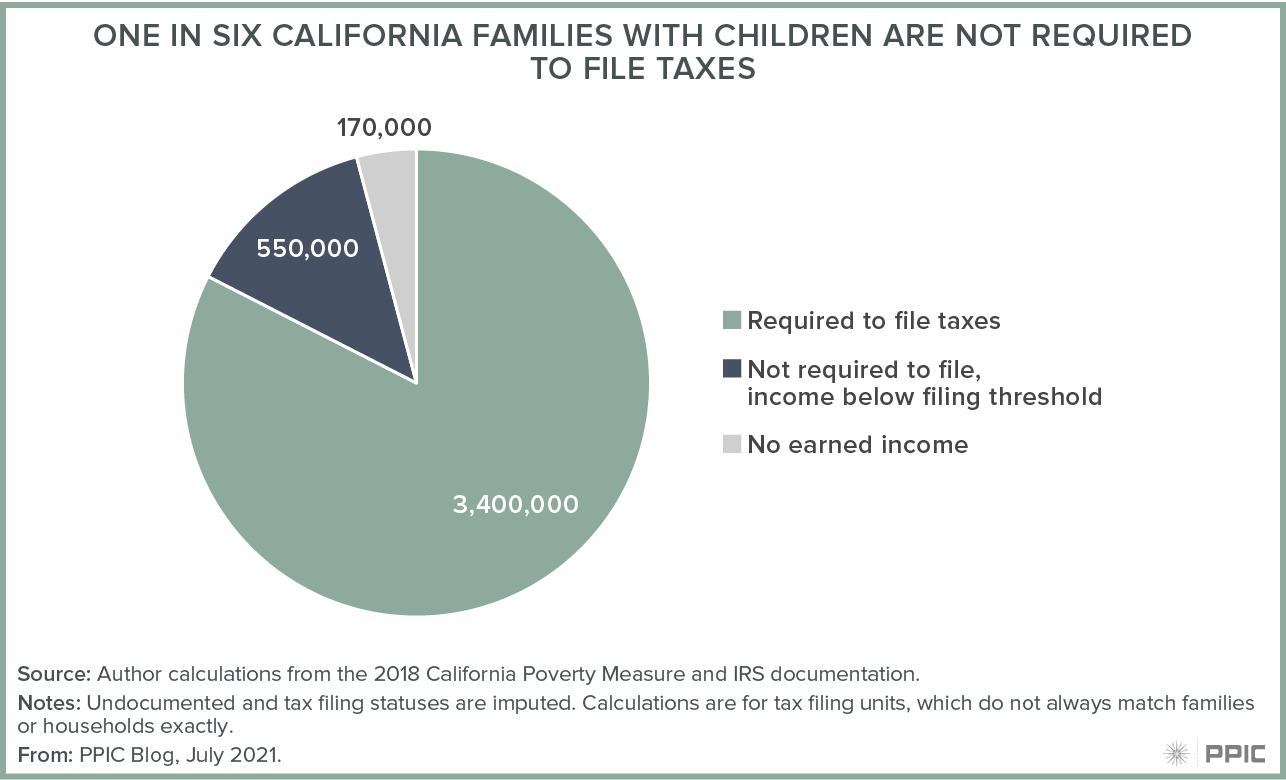

In 2018, about one in six citizen or permanent-resident families with children in California did not have to file taxes due to very low or no earnings. This included 550,000 tax filers with children who were not required to file because they had very little earned income. These families are newly eligible for the full amount of the expanded CTC. An additional 170,000 families had no earnings and are newly eligible for the expanded CTC. These lowest-earning families represent about 40% of all low-income California families (those with resources averaging under $51,000 for a family of four statewide). They represent about 31%–32% of low-income families in the Bay Area and Orange County, compared to 54% in the Central Valley and Sierra counties.

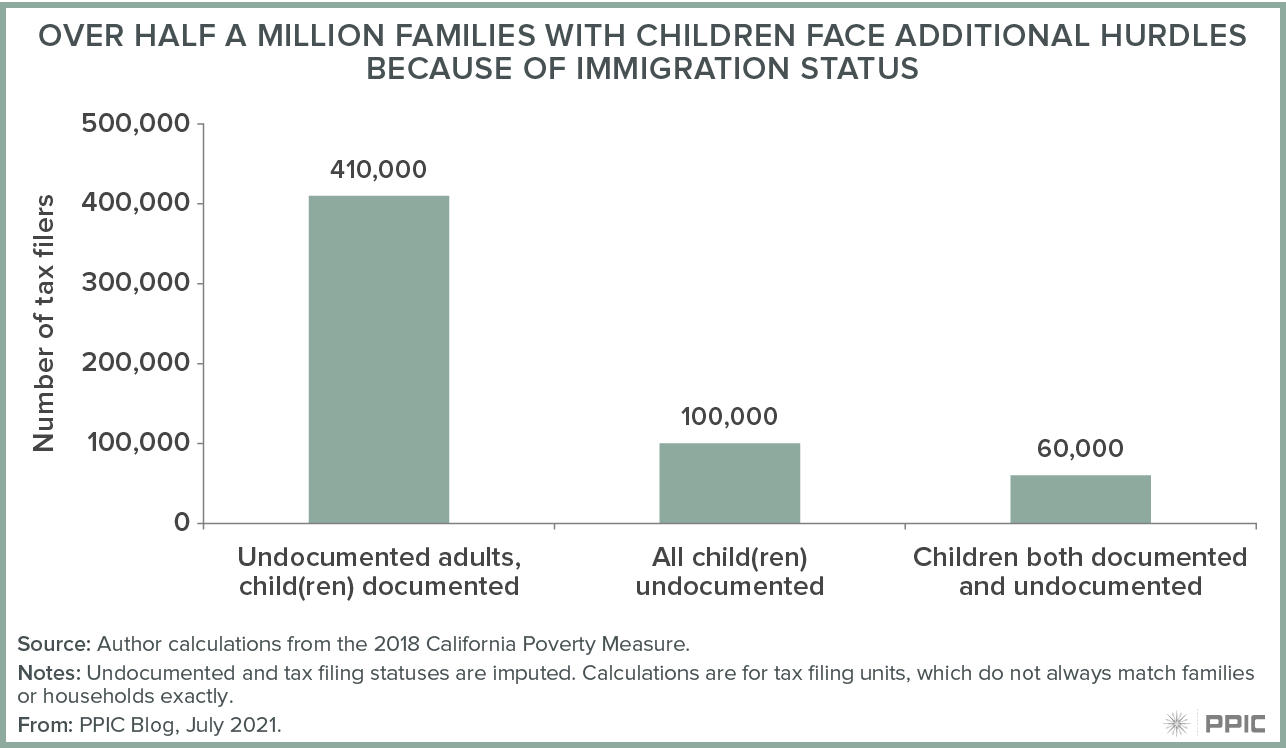

In addition, about 410,000 eligible families with undocumented adults may face additional hurdles. Some family members need Individual Tax Identification Numbers (ITINs) to file taxes, which can be time-consuming and difficult to obtain. Further, in California there are roughly 160,000 families with undocumented children who are ineligible or partly ineligible due to children’s immigration status. At 40%, the child poverty rate among mixed-immigration-status families is very high, indicating a need for the kind of stable support the expanded CTC is designed to provide.

In sum, the families who stand to gain most from the expansion likely need to take new action to engage with the IRS in order to receive payments. Those who are not required to file taxes can claim advance CTC payments without filing tax returns by sharing basic information with the IRS via the Non-Filer Sign-Up Tool. Since tax credits have become a major way of shoring up resources for low-income families, policymakers and stakeholders need to develop a detailed understanding of whether mechanisms like the non-filer tool are effective in reaching families equitably.