California has one of the highest poverty rates in the US when balancing family resources against housing costs and other basic needs like food and clothing. While state and federal measures, such as rent relief and a moratorium on evictions, have assisted families in the short run, the high cost of housing increases the challenge of alleviating poverty in the longer term.

Home prices soared during the pandemic recession—a contrast with the Great Recession, during which prices slumped. One way of calibrating the role of recent housing increases is to determine how poverty might have looked if prices had not risen after the Great Recession.

To do this, we apply data from the 2019 California Poverty Measure (CPM)—developed by PPIC and the Stanford Center on Poverty and Inequality—to housing costs if they had remained constant at 2013 spending levels. Under this scenario, we find that about 800,000 fewer Californians (2.2%) would have been in poverty in 2019.

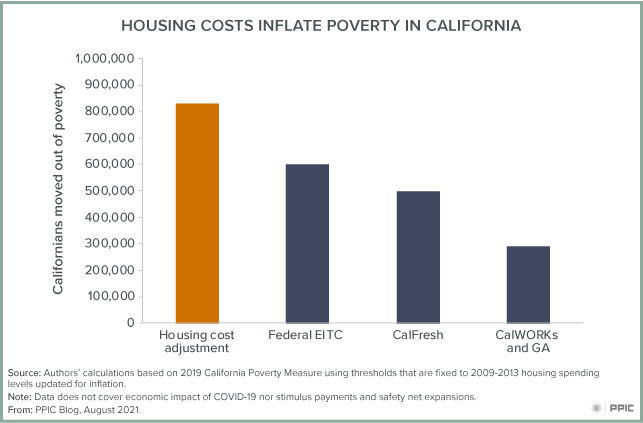

We are not measuring the actual housing costs individuals paid, but rather average costs across counties. A look at the number of Californians moved out of poverty by safety net programs—600,000 by the federal Earned Income Tax Credit (EITC), 500,000 by CalFresh, and 290,000 by CalWORKs and General Assistance (GA) together—indicates the outsized role that housing costs play. The housing adjustment affects the Bay Area the most: holding costs at 2013 levels would lower the poverty line by 12.3%. The adjustment affects northern counties—a group that ranges from Colusa County to Del Norte County—the least: it would lower the poverty line by 3.5%.

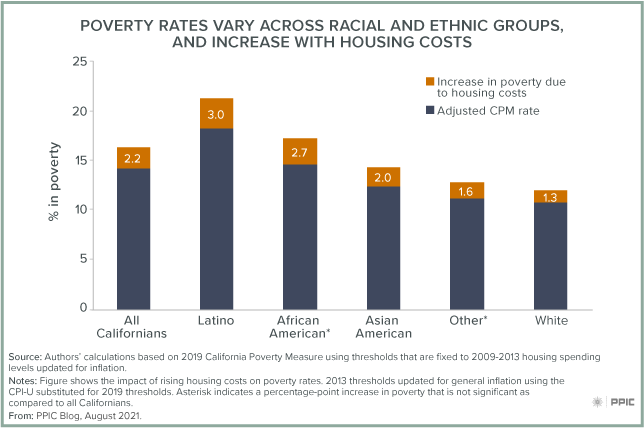

Holding housing costs at 2013 levels would lower poverty rates for all racial/ethnic groups. But rates for Latinos and African-Americans would fall the most, at 3.0 percentage points and 2.7 percentage points—versus 1.3 points for whites and 2.0 points for Asian Americans.

Renters see a somewhat larger effect compared to mortgage holders. This difference partly explains the outsized effects of housing costs on Latinos and African Americans: both are overrepresented in the renting population relative to their size in the overall population. Across age groups, the poverty rate for children would decrease from more than 17% to about 15%. The housing adjustment would lower the poverty rate by a substantial 4.0 points for adults age 25–64 with less than a high school diploma.

Until California can resolve its housing shortage, low- and moderate-income Californians will struggle to find places to live that fit within their constrained budgets. The governor and state legislature have taken some steps: the California Comeback Plan includes a $12 billion funding package for homelessness and allocates more than $10 billion for affordable housing. This and other legislation represents an opportunity to ease the housing burden for low-income families and groups most affected by the pandemic recession.