Table of Contents

Key Findings

Jobs and the economy are a top concern as Californians set a future course in the November election. Although job growth has been relatively strong as the state and nation recover from the COVID-19 crisis, residents are dealing with rising prices on consumer goods and high gasoline costs. Lower-income Californians are also facing high housing costs, while upper-income Californians have recently experienced setbacks in the financial markets. Meanwhile, state and federal governments have made substantial investments in services and programs to expand economic opportunity over the past year.

These are among the key findings of a statewide survey on economic well-being that was conducted from October 7 to October 21 by the Public Policy Institute of California.

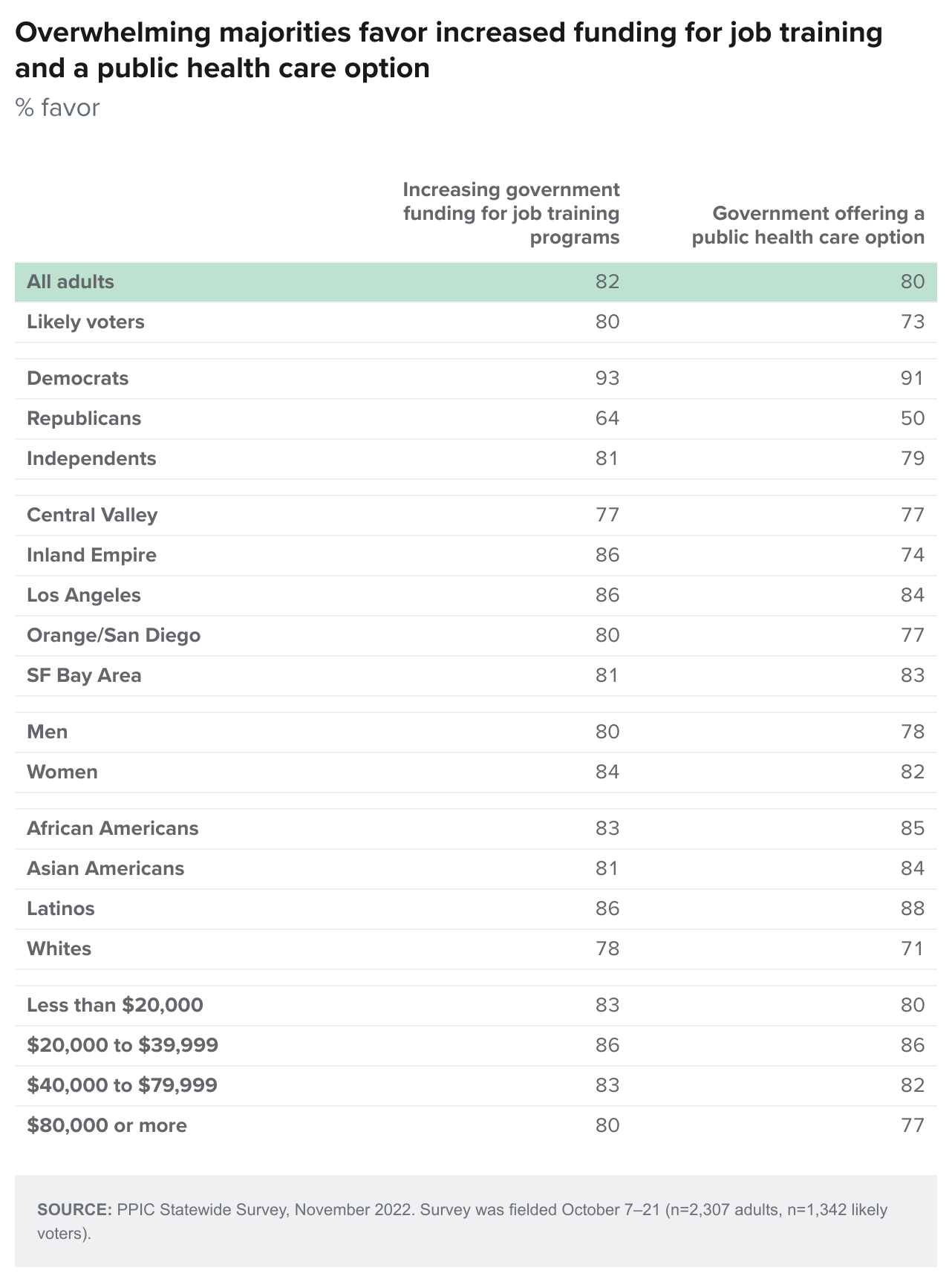

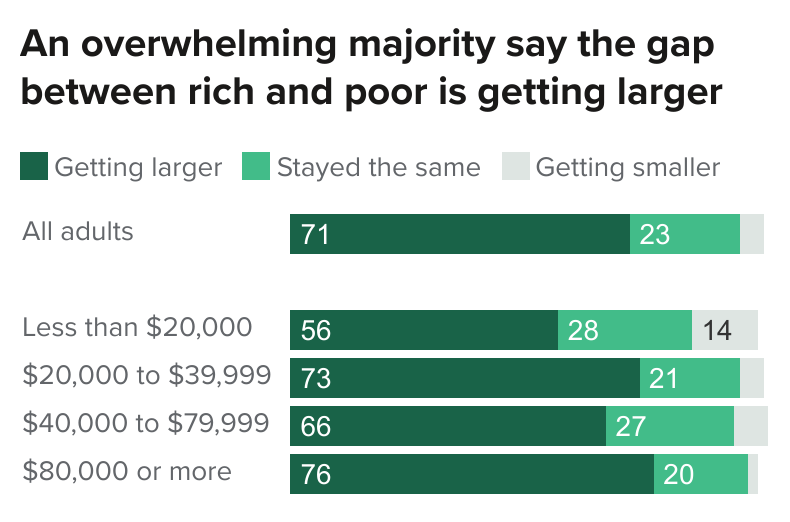

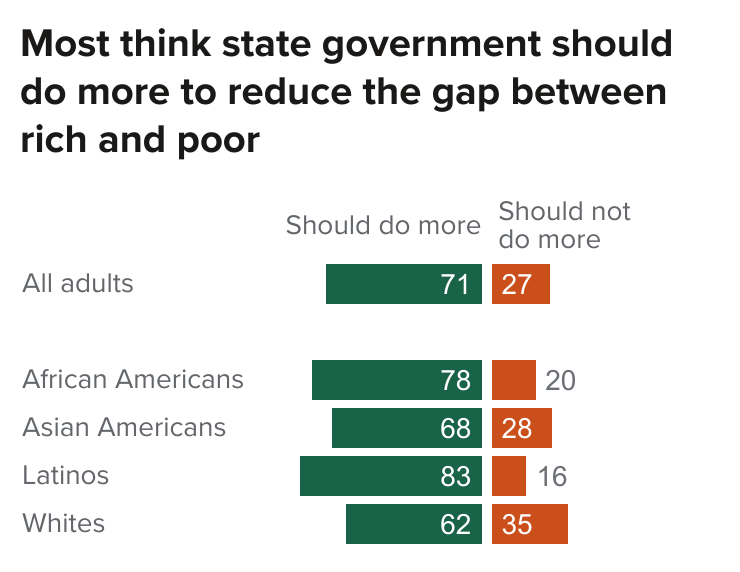

Strong majorities of Californians say the gap between the rich and the poor is getting larger (71%) and children growing up in California today will be worse off than their parents (67%). Seven in ten say the state government should do more to reduce the gap between the rich and poor.

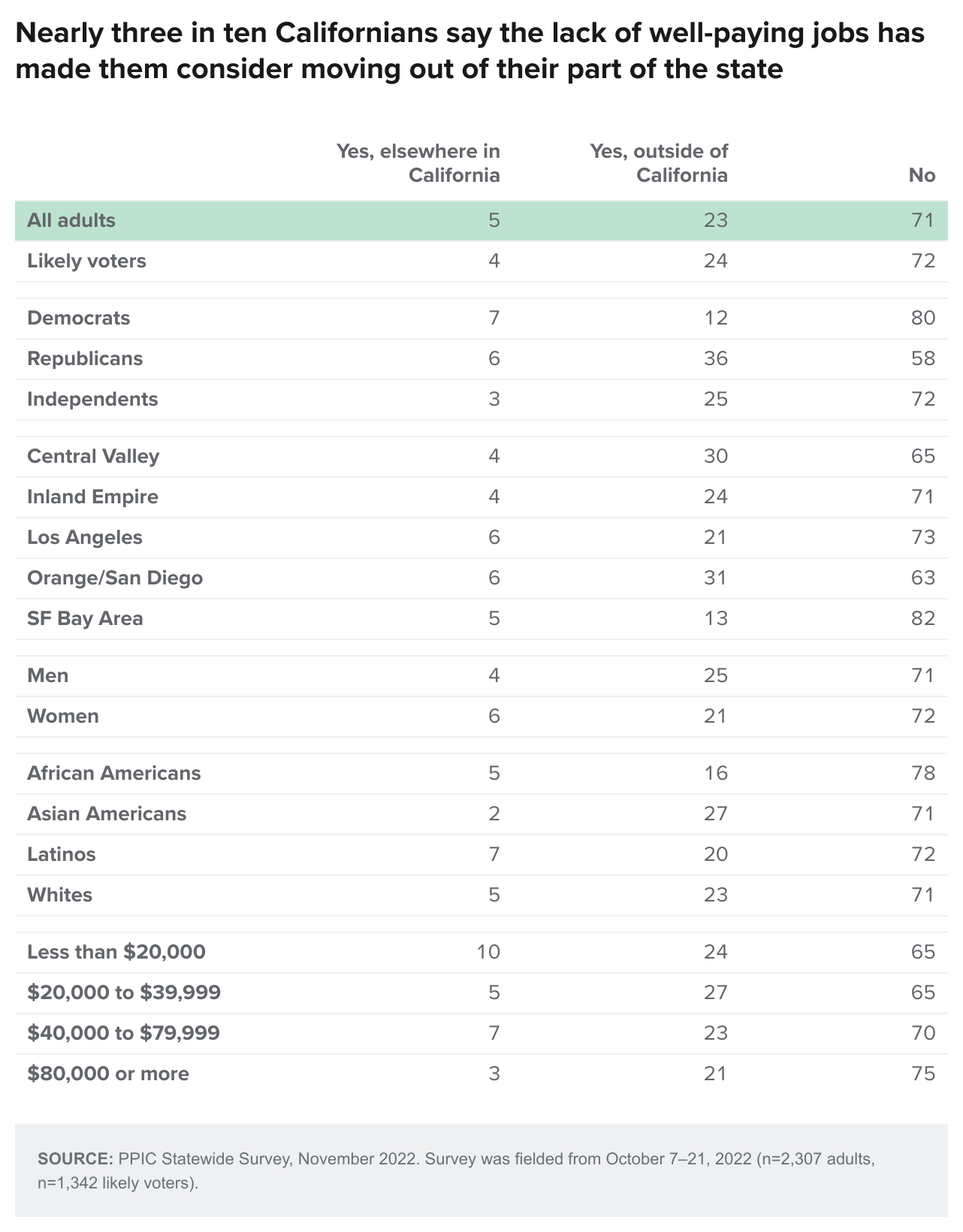

Strong majorities of Californians say the gap between the rich and the poor is getting larger (71%) and children growing up in California today will be worse off than their parents (67%). Seven in ten say the state government should do more to reduce the gap between the rich and poor.- Most Californians are predicting bad times for the state economy in the next 12 months (69%). Twenty-four percent of Californians say the lack of well-paying jobs in their region is a big problem, with lower-income residents making less than $40,000 somewhat more likely to hold this view. Twenty-three percent of Californians say the lack of well-paying jobs is making them seriously consider moving out of the state. →

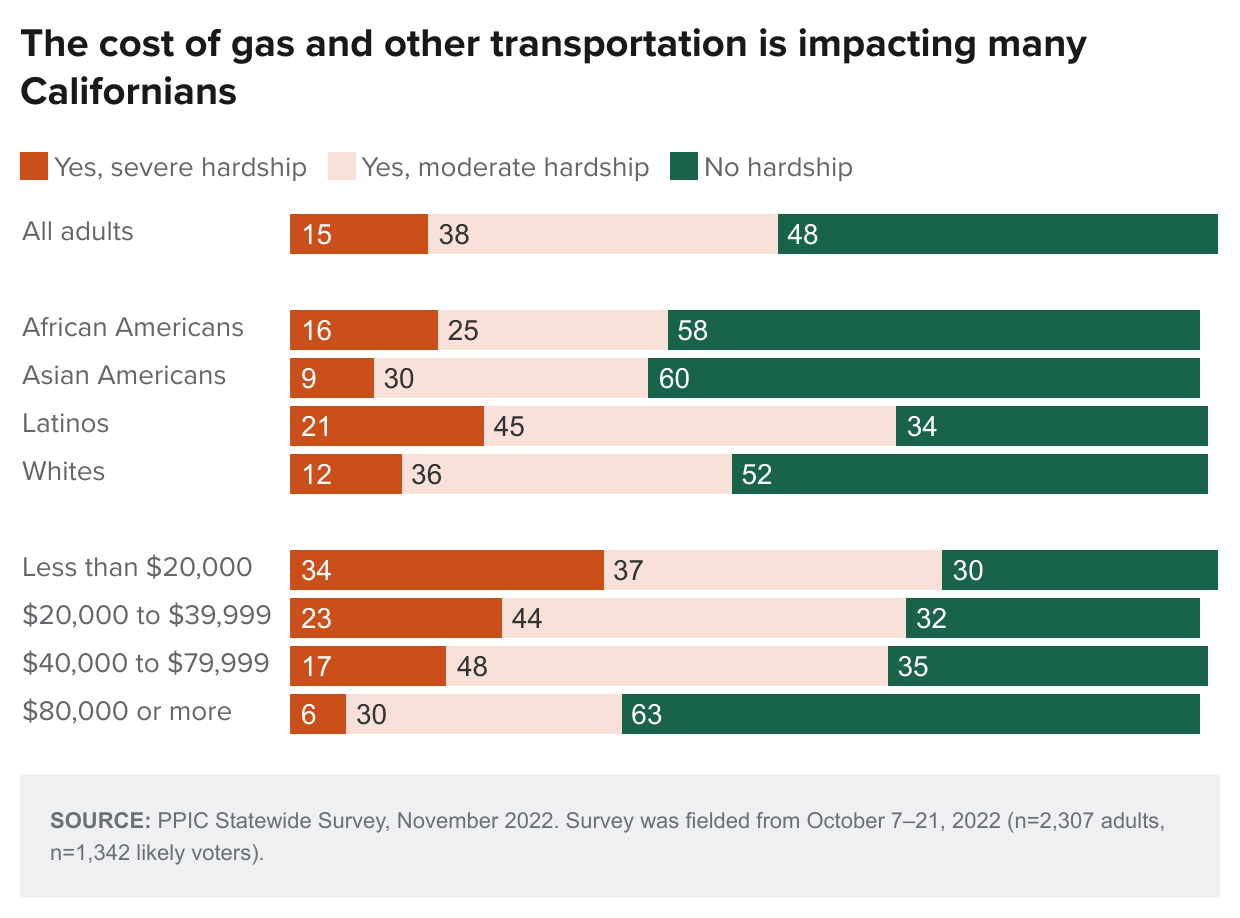

- Most Californians say they are satisfied with their household’s financial situation, while about four in ten or more lower-income residents are not satisfied. About half of Californians are upset about rising prices and a similar proportion say the cost of gasoline or other transportation is causing hardships. Many lower-income residents say it would be difficult to cover a $1,000 emergency expense. →

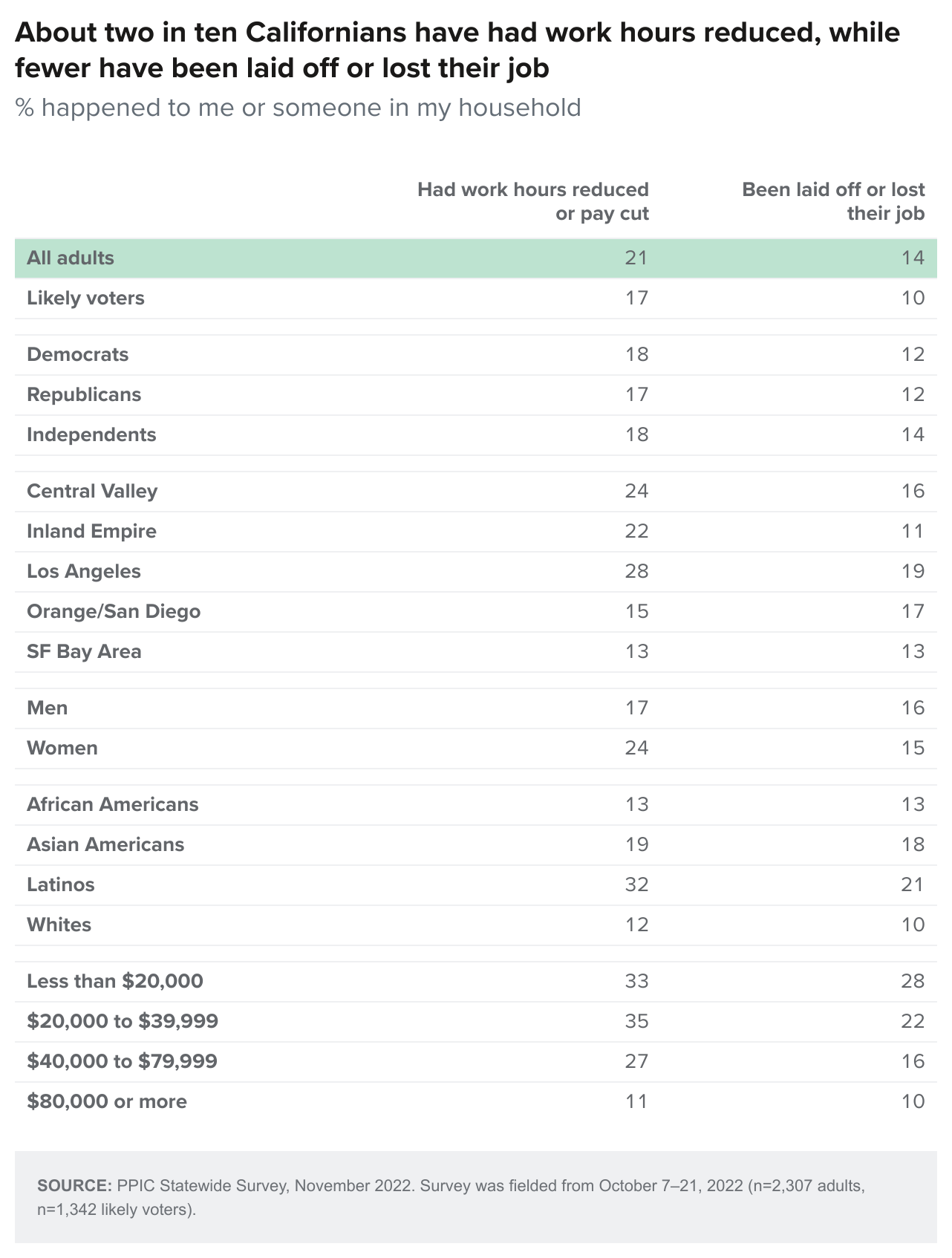

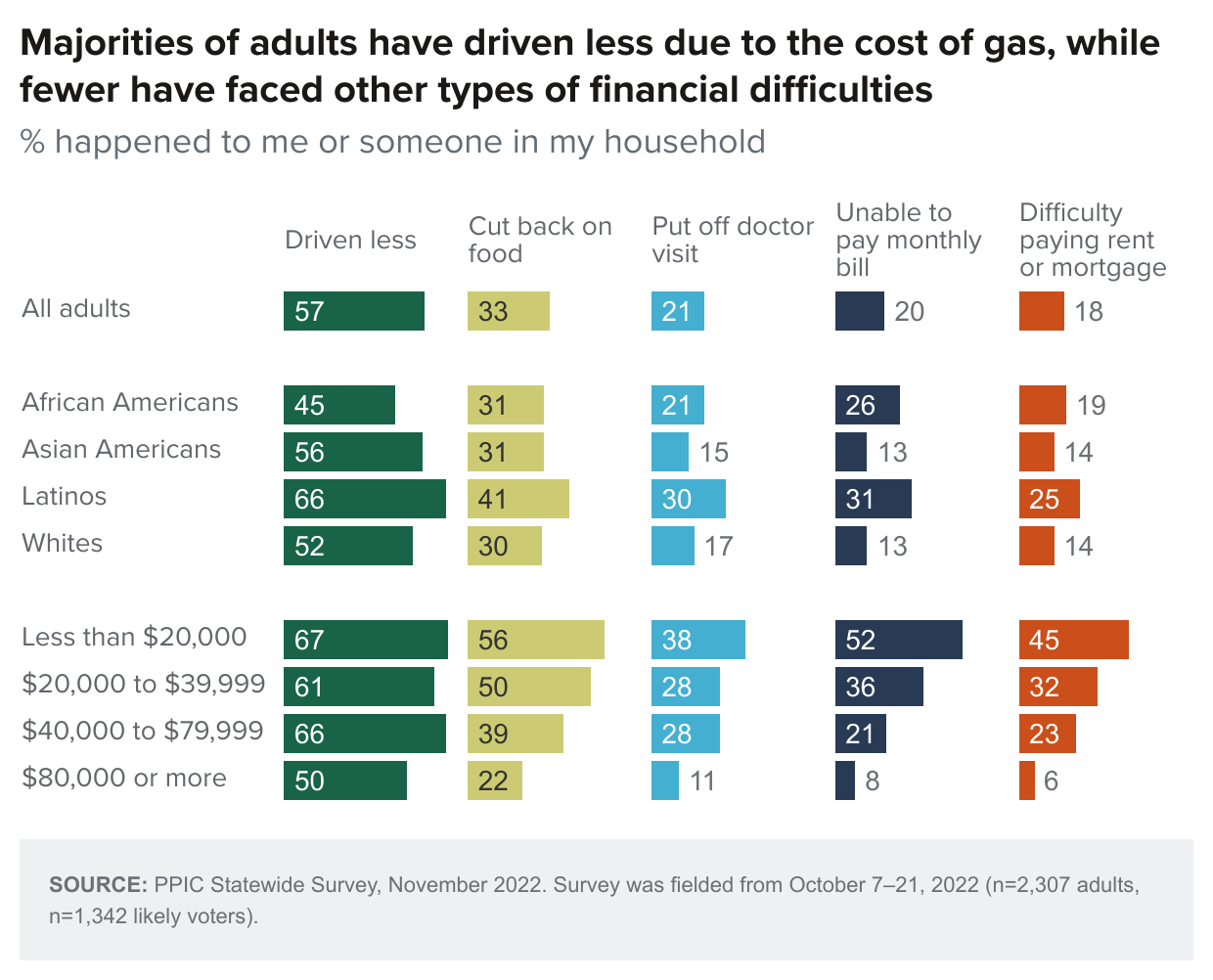

- Half or more Californians across income groups report having driven less due to the cost of gasoline in the past 12 months. One-third report having reduced meals or cut back on food to save money, including half of lower-income residents. Twenty-one percent report having work hours reduced or pay cut this past year, including about one-third of lower-income residents. →

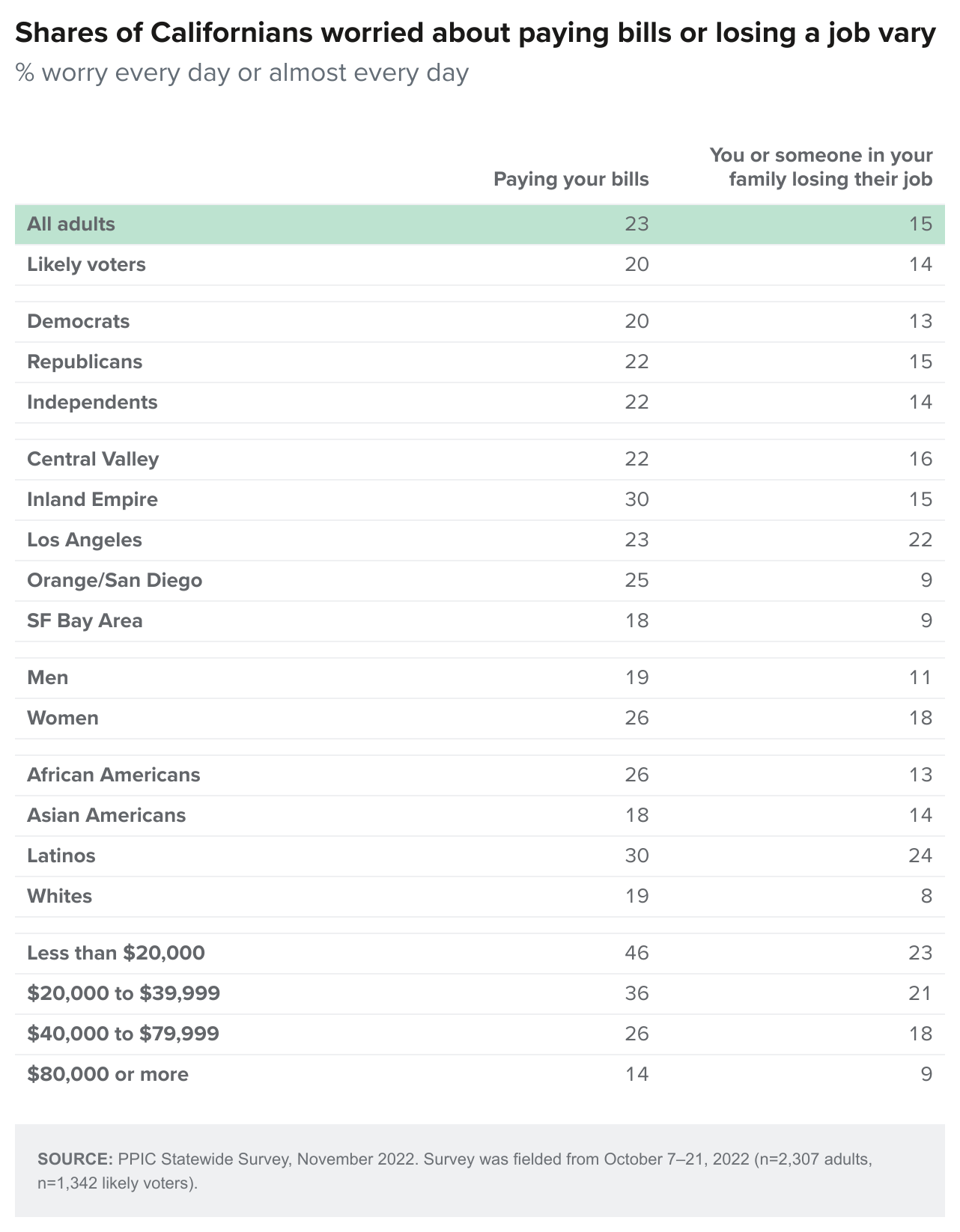

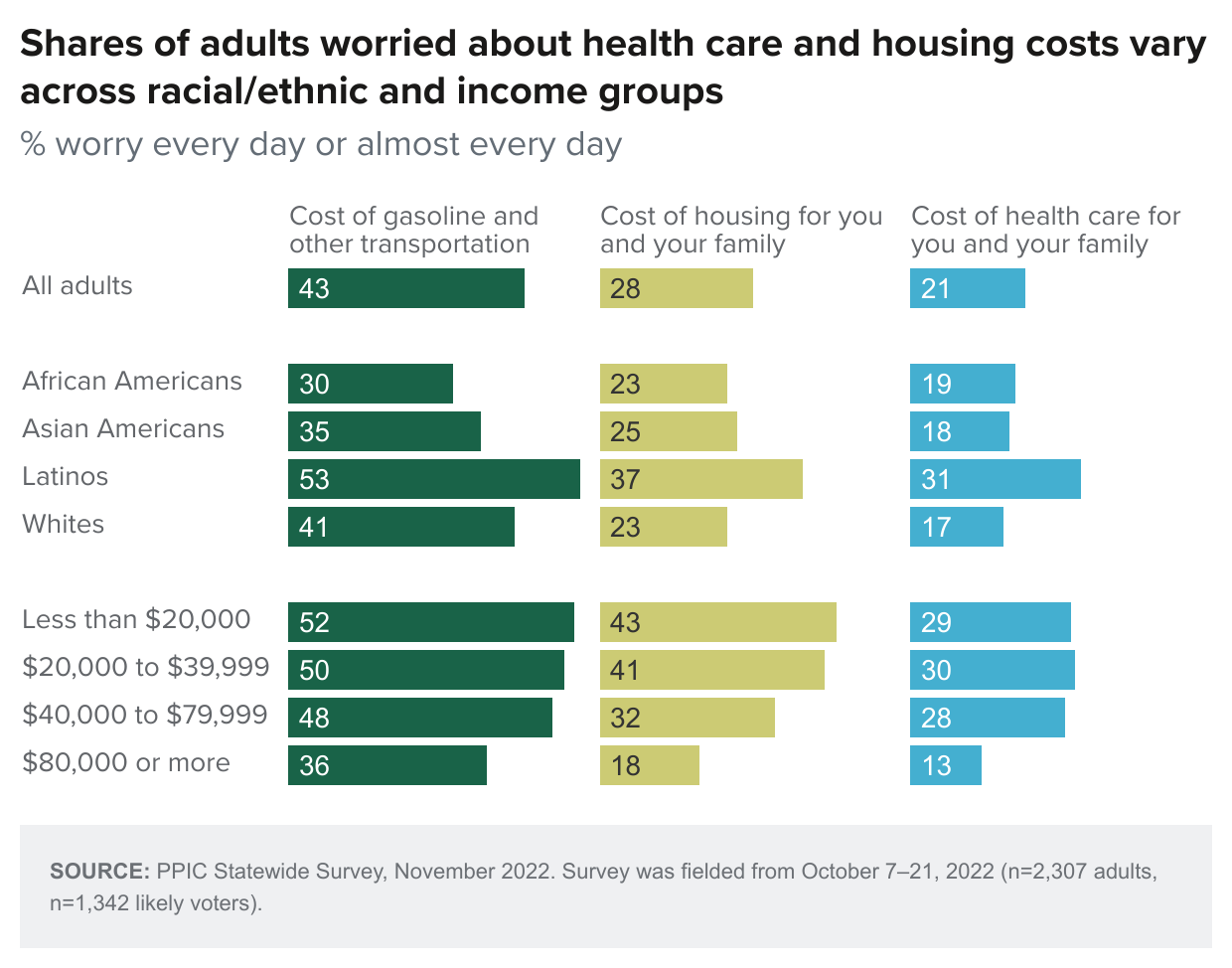

- Forty-three percent of Californians—including half of lower-income residents—worry every day or almost every day about the cost of gasoline and other transportation. Nearly three in ten adults, and about four in ten lower-income residents, are similarly worried about the cost of housing. About a quarter or more worry every day or almost every day about the debt they have and saving for retirement. Four in ten lower-income Californians worry every day or almost every day about paying their bills. →

Most employed residents are somewhat satisfied with their jobs, and eight in ten report having at least a fair amount of job security. Majorities say their jobs offer opportunities for advancement and educational or training assistance. Lower-income employed residents have less positive views. Overwhelming majorities of adults agree that voting gives people like them a say in government and that it is important for workers to organize so that employers do not take advantage of them. →

Most employed residents are somewhat satisfied with their jobs, and eight in ten report having at least a fair amount of job security. Majorities say their jobs offer opportunities for advancement and educational or training assistance. Lower-income employed residents have less positive views. Overwhelming majorities of adults agree that voting gives people like them a say in government and that it is important for workers to organize so that employers do not take advantage of them. →- Majorities favor several government policies aimed at increasing economic well-being. For example, overwhelming majorities favor government policies to increase the amount of affordable rental housing and to increase housing production so more Californians could purchase a home. Two in three adults, and three in four lower-income residents, support government policy to make college tuition free at both public two-year and four-year colleges. And solid majorities across partisan groups favor increasing government funding for job training programs. →

California Economy

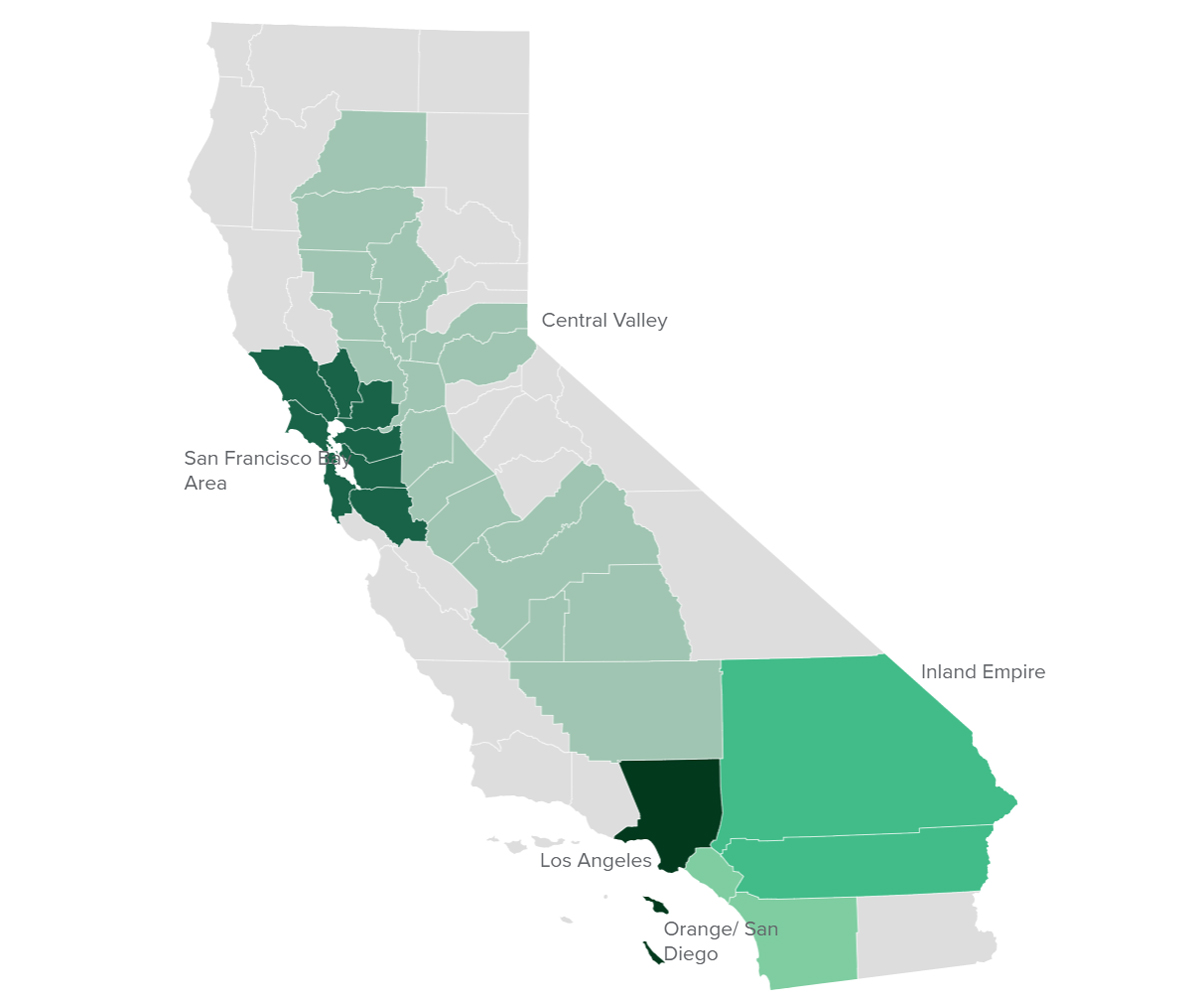

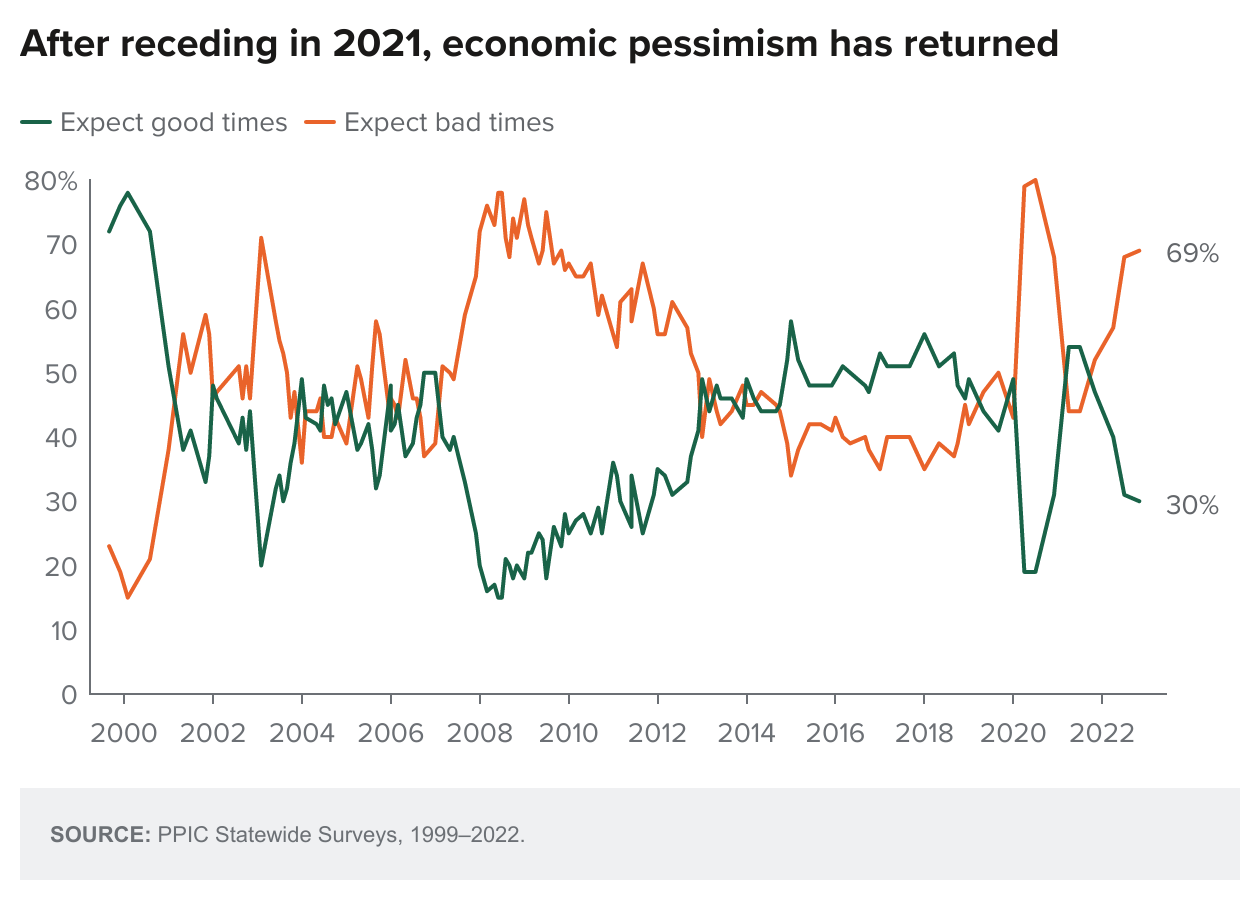

The share of Californians expecting good times in the next 12 months continued to decline last month, after rebounding in 2021. Just three in ten Californians are optimistic today, while seven in ten are pessimistic. Findings today are much closer to December 2020 (31% good times, 68% bad times) than November 2021 (47% good times, 52% bad times). Majorities across parties, regions, and demographic groups are pessimistic, although pessimism is far lower among Democrats (57%) than independents (77%) or Republicans (89%). Additionally, African Americans (54%) are the least likely across racial/ethnic groups to be pessimistic (64% Latinos, 72% whites, 73% Asian Americans). Pessimism is lowest in Los Angeles (60%) and highest in the Central Valley (75%). When asked a similar question about economic conditions during the next five years, Californians are only slightly more optimistic, with 37 percent expecting good times and 62 percent expecting periods of depression or unemployment.

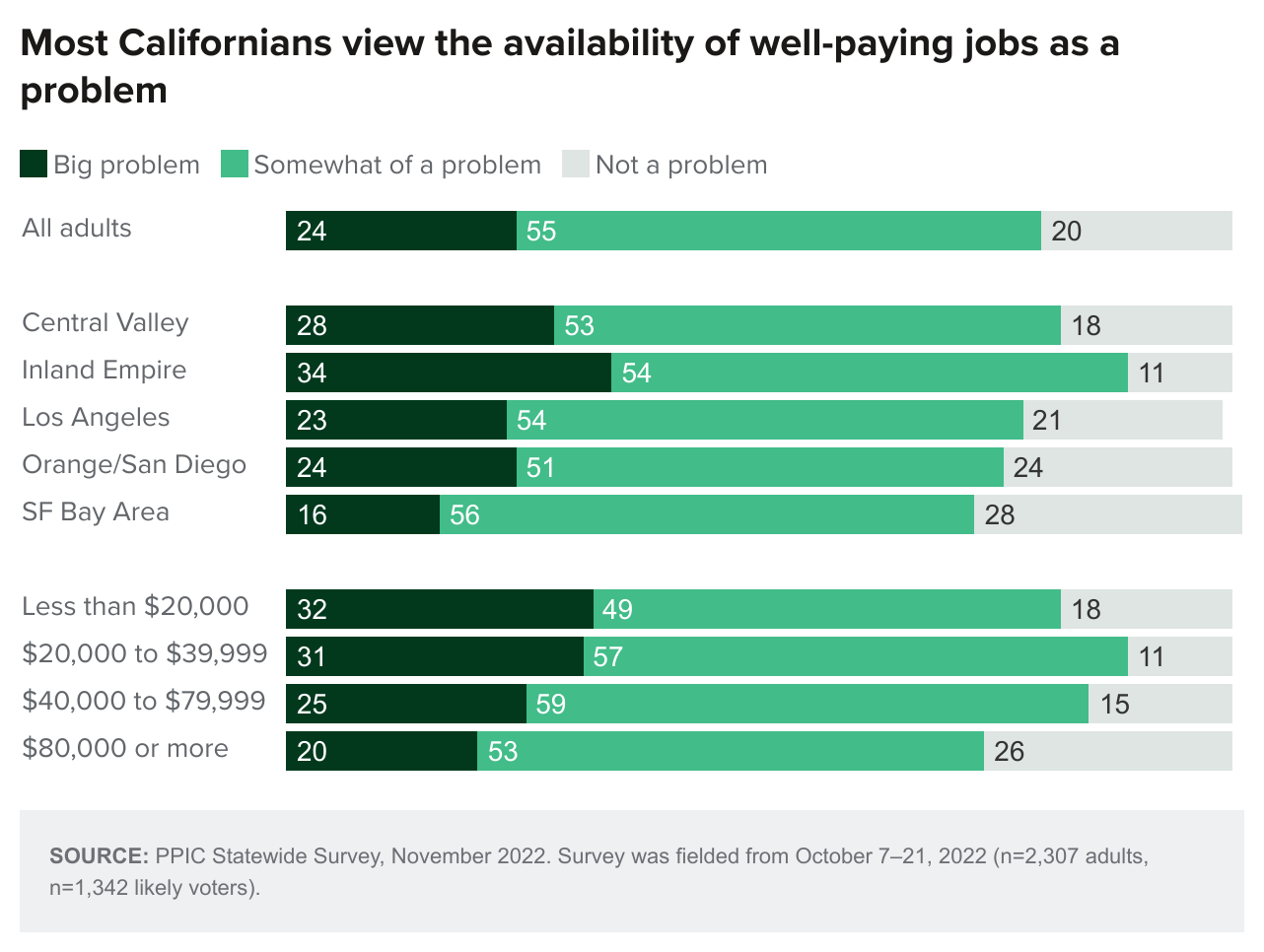

Eight in ten Californians view the availability of well-paying jobs as a problem (24% big, 55% somewhat), while just one in five say it is not a problem. Findings were nearly identical last November (22% big problem, 57% somewhat of a problem, 21% not a problem), while slightly more viewed this lack of well-paying jobs as a problem in December 2020 (27% big problem, 61% somewhat of a problem, 12% not a problem). Today, residents in the Inland Empire are the most likely—and those in the San Francisco Bay Area the least likely—to say the availability of well-paying jobs is a problem. More than three in four across parties view it as a problem. While more than seven in ten across demographic groups view the availability of well-paying jobs as a problem, it is notable that the share declines with rising income. Among Californians with incomes of less than $40,000, younger Californians are much more likely than older adults to say the lack of well-paying jobs is a big problem.

When asked if the lack of well-paying jobs has made them seriously consider moving away from their part of California, 28 percent of Californians say yes. Findings have been similar each time we have asked this question (26% November 2021, 32% December 2020). Today, Republicans, residents in Orange/San Diego and the Central Valley, non–college graduates, renters, and lower-income Californians are more likely than others to report considering moving from their part of California. Among those who have considered moving, most would leave the state rather than go somewhere else in California. Among Californians with incomes of less than $40,000, younger Californians are much more likely than older adults to say they have seriously considered moving out of their part of California.

Personal Finances

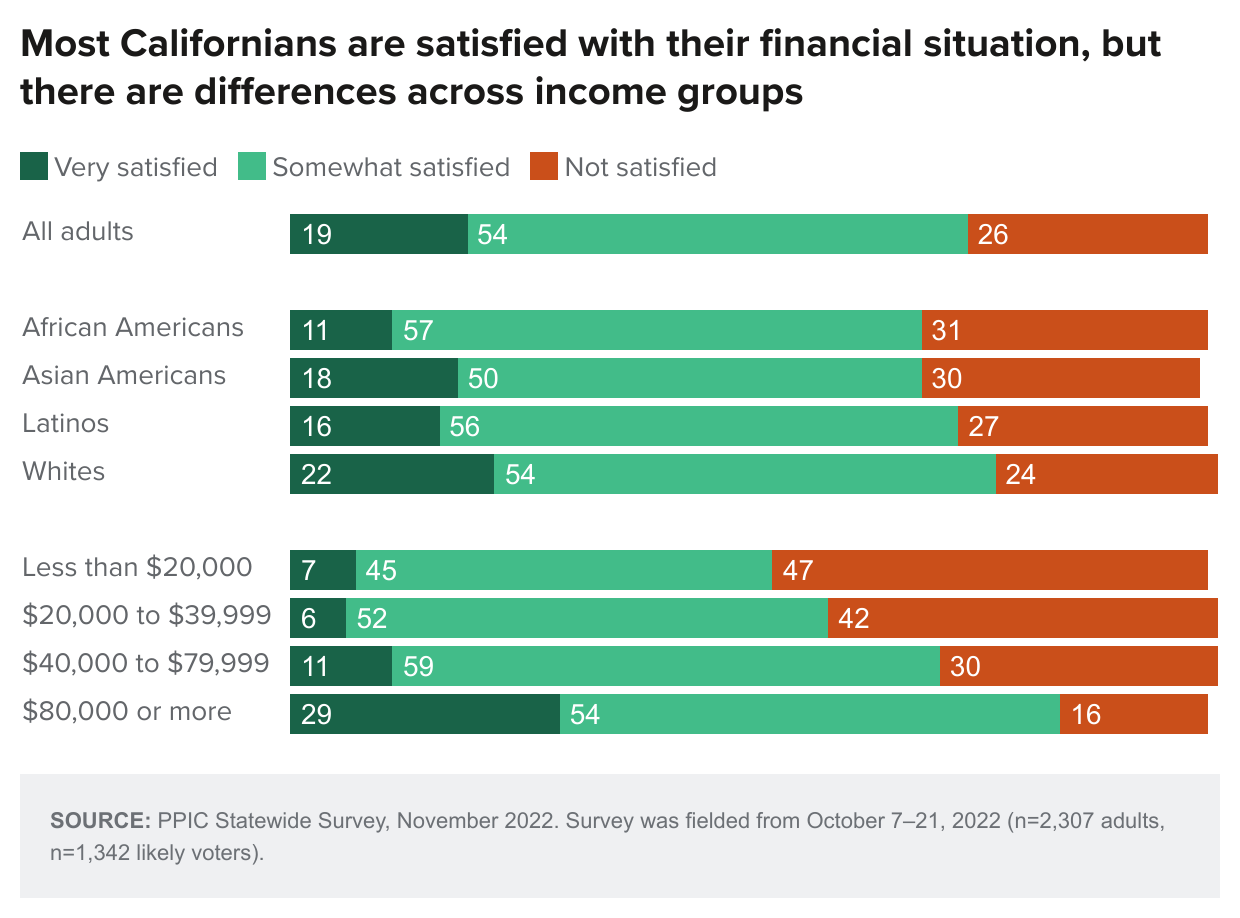

When asked about their household’s financial situation, nearly three in four Californians say they are satisfied—but only one in five are very satisfied. Views were similar last November (21% very satisfied, 57% somewhat satisfied, 22% not satisfied). Today, satisfaction rises along with income. Notably, nearly half of those with incomes of $20,000 or less are not satisfied. Strong majorities across regions and across age, education, gender, and racial/ethnic groups say they are at least somewhat satisfied, but it is noteworthy that residents in the Central Valley and Inland Empire, African Americans, and those without a college degree are the least likely to be very satisfied.

When asked how difficult it would be to handle an emergency expense of $1,000, a majority of Californians (55%) say this would be not too difficult, while fewer say it would be somewhat difficult (25%), very difficult (12%), or nearly impossible (7%). About half or more across regions and parties say this expense would not be too difficult. The perception that this expense would not be too difficult is far more common among those making $80,000 or more (76%) than among those making under $40,000 (12% less than $20,000, 33% $20,000 to $39,999); it is also much more common among whites (67%) and Asian Americans (65%) than among African Americans (40%) and Latinos (37%). This perception also rises sharply with increasing age and education.

While gas prices have seemingly decreased somewhat in recent weeks, they remain higher than they have been in recent years, and this is causing hardship for many Californians. A majority of residents say that the cost of gasoline or other transportation is causing them hardship, while 48 percent say these costs are not causing hardship. Across regions, hardship is experienced most often among those in the Central Valley (64%) and the Inland Empire (63%), followed by those in Orange/San Diego (51%), Los Angeles (49%), and the San Francisco Bay Area (37%). Across racial/ethnic groups, Latinos are the most likely to report hardship. The share of Californians reporting hardship declines as household income increases. The share experiencing hardship decreases with higher educational attainment. Republicans (64%) and independents (55%) are much more likely to report hardship than Democrats (42%). Among Californians earning less than $40,000, those without a college degree are much more likely to say they have experienced hardship.

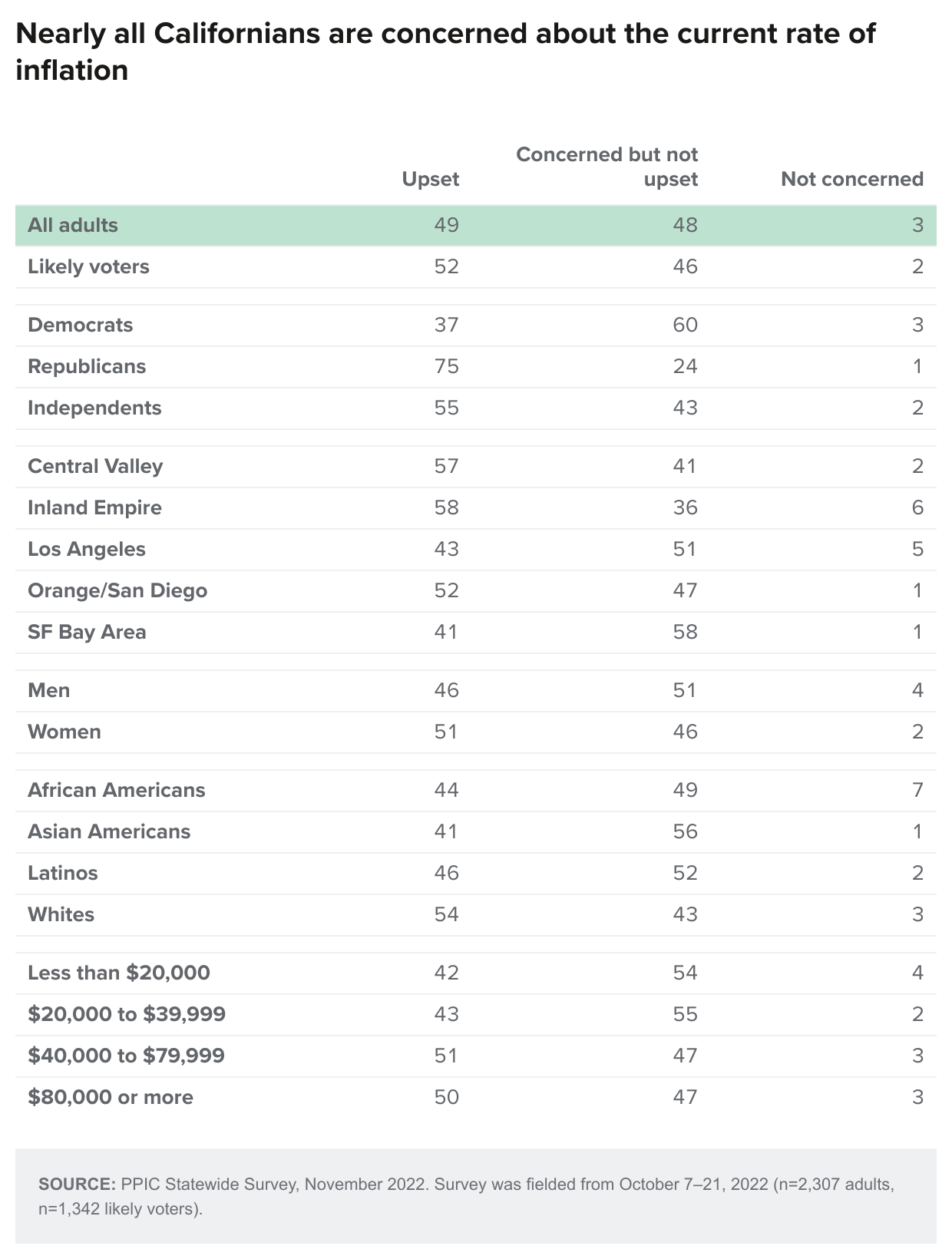

When asked about the current rate of inflation, 49 percent of Californians say they are upset and another 48 percent say they are concerned but not upset, while very few (3%) say they are not concerned. More than half of residents in the Inland Empire, the Central Valley, and Orange/San Diego say they are upset, compared to fewer in Los Angeles and the San Francisco Bay Area. Across demographic groups, whites, younger Californians age 18 to 34, and those with incomes higher than $40,000 are the most likely to be upset. Those with some college education (58%) are much more likely to be upset than those with a high school diploma or less (44%) and those with a college degree (44%). Among Californians earning less than $40,000, women are more likely than men to say they are upset about the current rate of inflation.

Economic Security

A majority of Californians report that they or someone in their household have had to drive less due to the cost of gasoline (57%) over the past year. One in three have had to reduce meals or cut back on food to save money, and about two in ten say they have had to put off seeing a doctor (21%), were unable to pay a monthly bill (20%), or had difficulty paying their rent or mortgage (18%) over the past year. Findings are similar to a year ago for all except the share driving less, as this is a new question.

Roughly three in ten or more among households earning less than $40,000 report experiencing these types of difficulties. Two in ten or fewer among households making more than $80,000 report cutting back on food, putting off doctor visits, having difficulty paying rent/mortgage, or being unable to pay a monthly bill, but half of higher-income adults say they have driven less due to the cost of gas. Renters are more likely than homeowners to report experiencing most of these hardships—but the shares reporting driving less are similar among homeowners and renters. Across racial/ethnic groups, Latinos are the most likely to report any of these difficulties. Residents in the Central Valley and Inland Empire are more likely to report any of these hardships than those in other regions.

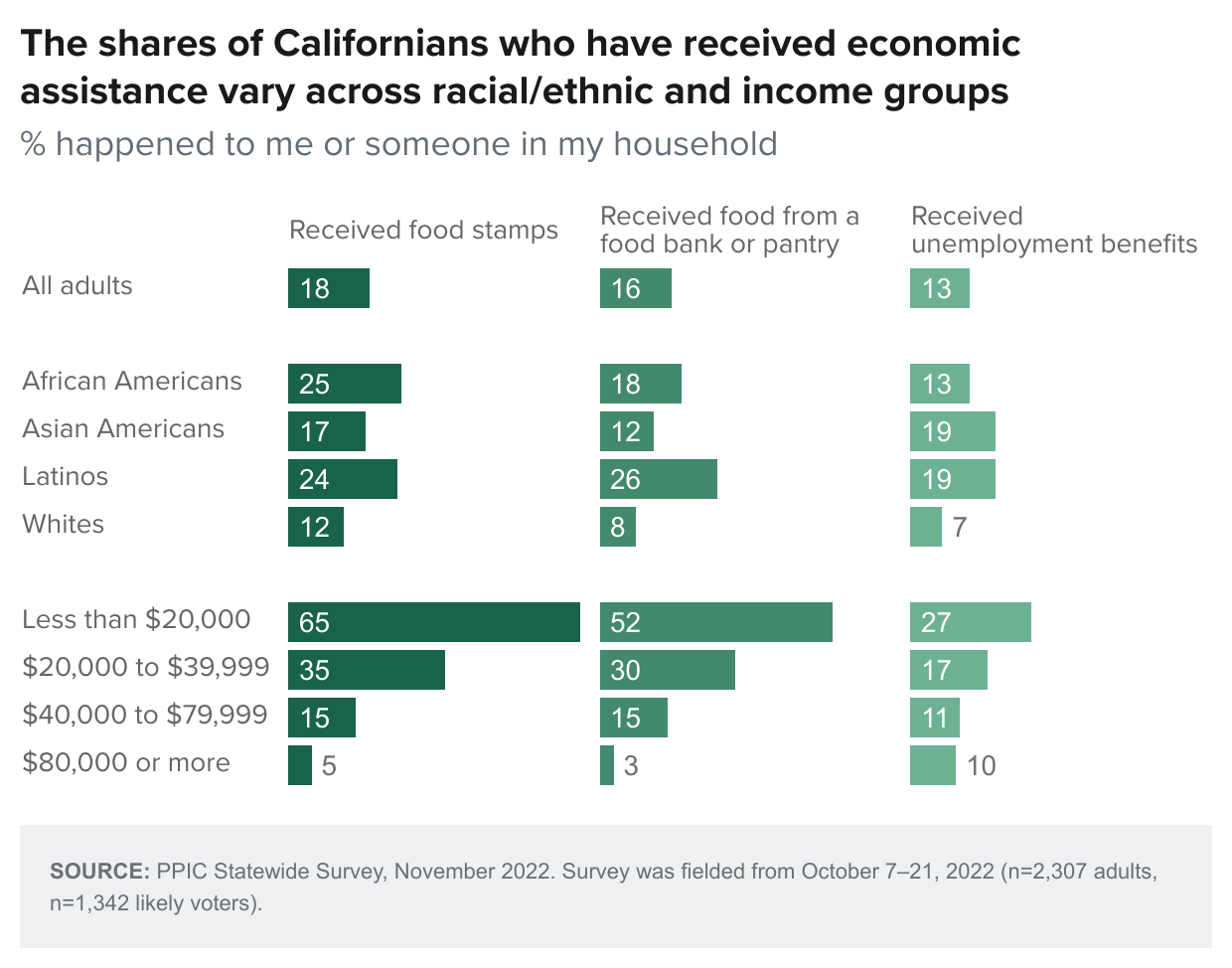

About two in ten or fewer Californians say they or someone in their household has received food stamps (18%), food from a food bank or pantry (16%), or unemployment benefits (13%) in the past year. The shares saying they have received food stamps or assistance from a food bank were similar a year ago, while the share saying they have received unemployment benefits has declined by 14 percentage points (from 27% in November 2021). Today, there are significant differences across income groups: households earning less than $20,000 are the most likely to report receiving these types of economic assistance. Renters more often report receiving these types of economic assistance than homeowners do. Across racial/ethnic groups, African Americans and Latinos are the most likely to report receiving food stamps, Asian Americans and Latinos are the most likely to say they have received unemployment benefits, and Latinos are the most likely to say they have received food from a food bank.

About two in ten adults report that they or someone in their household had their work hours reduced or pay cut and 14 percent say they or someone in their household was laid off or lost their job in the past 12 months. Latinos, adults with incomes less than $40,000, and renters are the most likely to say they have been laid off or lost their job. Across demographic groups, Latinos and adults with incomes of less than $40,000 are the most likely to report either of these difficulties—and, notably, women are more likely than men to say they have had work hours or pay reduced. Across the state’s regions, residents in Los Angeles are the most likely to report either of these difficulties.

Financial Worries

More than four in ten Californians worry every day or almost every day about the cost of gasoline and other transportation (43%), about three in ten worry about the cost of housing (28%), and two in ten worry about the cost of health care (21%). Similar shares expressed concern about the cost of housing and health care a year ago. Today, these concerns are more common in lower-income households—about three in ten or more Californians earning less than $20,000 worry about these financial issues every day or almost every day. Across racial/ethnic groups, Latinos are the most likely to worry. Women (49%) are more likely than men (37%) to say they are worried about the cost of gas and other transportation. Four in ten or more across regions worry about fuel costs, with the exception of the San Francisco Bay Area (31%). The share worried about these three financial issues decreases as education level increases. Notably, renters (40%) are about twice as likely as homeowners (19%) to worry about the cost of housing almost every day.

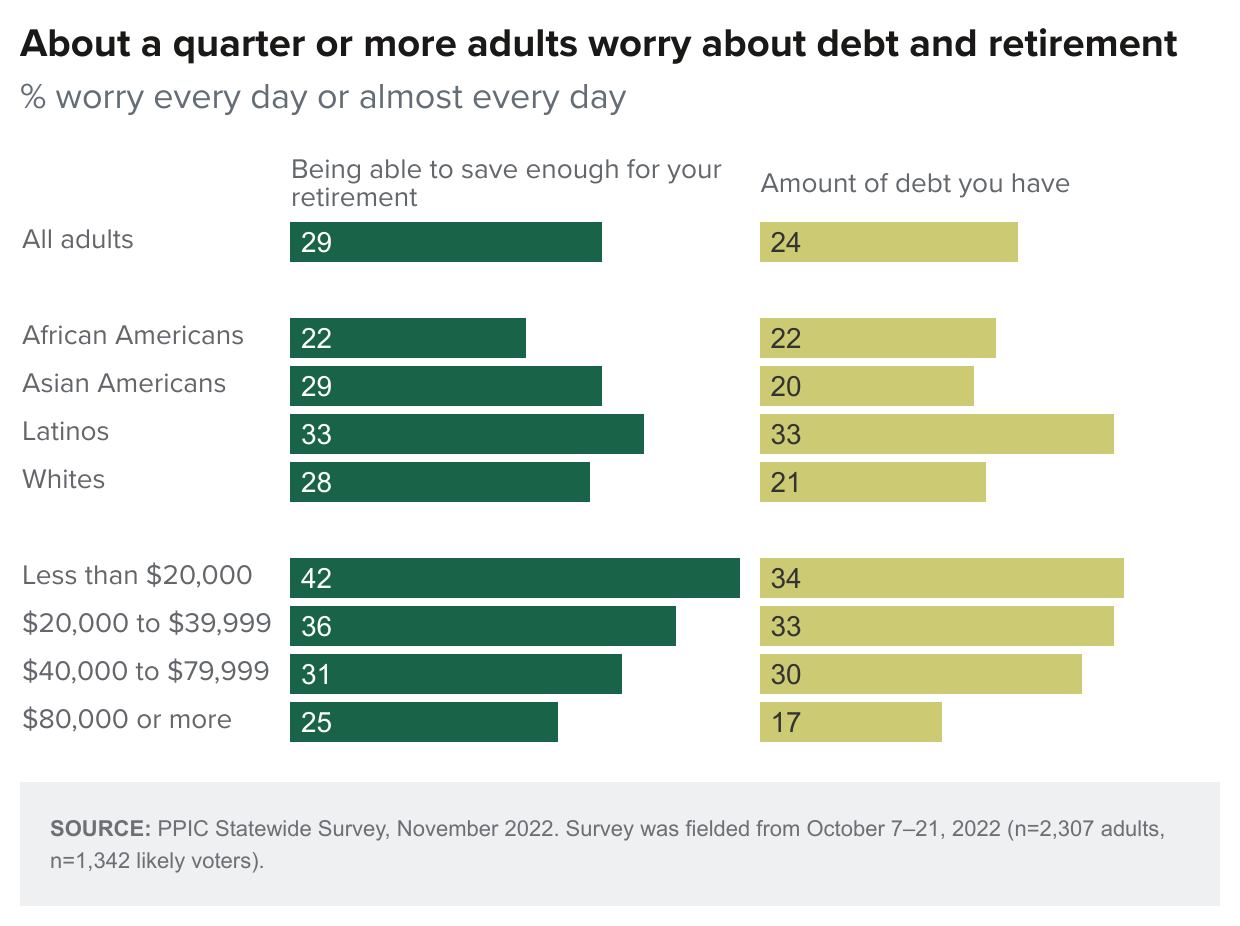

Three in ten Californians worry every day or almost every day about being able to save enough for retirement (29%), and about a quarter worry about the amount of debt they have (24%)—these shares are similar to a year ago. Across racial/ethnic groups, one in three Latinos worry about being able to save for retirement and about debt, compared to somewhat fewer African Americans, Asian Americans, and whites. Across income groups, Californians earning less than $20,000 are the most likely to worry, with 42 percent worrying every day or almost every day about being able to save for retirement and 34 percent worrying about the amount of debt they have. About one in three or fewer across the state’s regions worry about these issues.

About a quarter of Californians worry every day or almost every day about paying their bills (23%), and 15 percent worry about they or someone in their family losing their job. The share worrying about these issues decreases as income rises, with Californians earning less than $20,000 most likely to report being worried. Women are somewhat more likely than men to worry about these issues. Across racial/ethnic groups, Latinos are the most likely to worry about both of these concerns. Concern about job loss is highest in Los Angeles, while concern about paying bills is highest in the Inland Empire. Renters are nearly twice as likely as homeowners to worry about paying bills.

Job Conditions

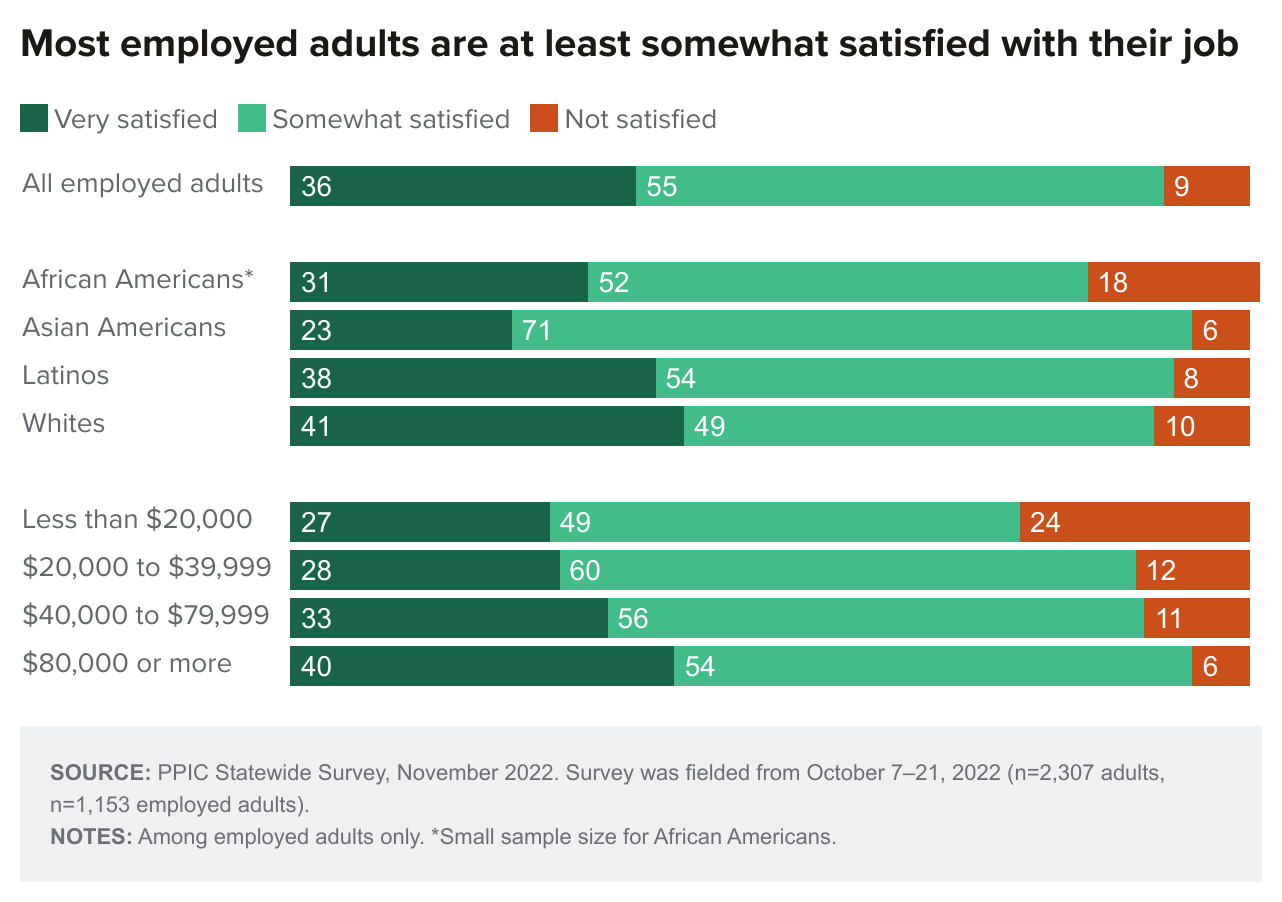

When asked about job satisfaction, 36 percent of employed adults say they are very satisfied and 55 percent are somewhat satisfied, while 9 percent are not satisfied with their current job. Satisfaction levels were similar last November (37% very satisfied, 53% somewhat satisfied). Across regions, Central Valley residents (43%) are the most likely to say they are very satisfied with their current job, while San Francisco residents (30%) are the least likely to say this. Across demographic groups, men (41%) are more likely than women (30%) to be very satisfied and Asian Americans are less likely than other racial/ethnic groups to say this. The shares saying they are very satisfied increases with rising income and age (29% 18 to 34, 37% 35 to 54, 45% 55 and older). Employed adults earning less than $20,000 are the least likely across all demographic groups to be very or somewhat satisfied with their current job.

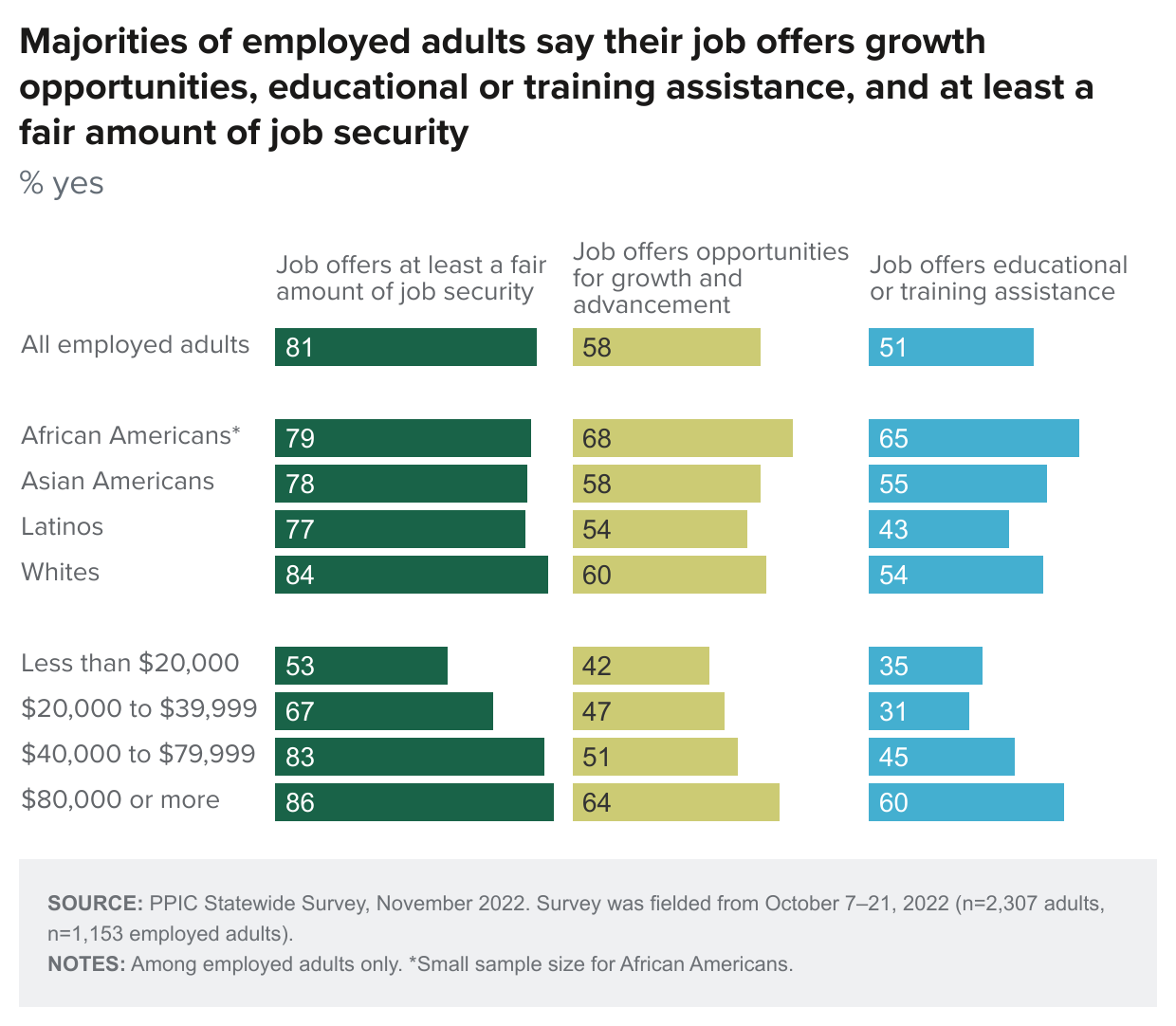

Fifty-eight percent of employed Californians say their jobs offer opportunities for growth. About half (51%) say they are provided with educational or training assistance, and 81 percent say they have at least a fair amount of job security. Shares reporting opportunities for growth and educational or training assistance were similar in November 2021.

Similar shares of men and women say they are offered educational or training assistance and have a fair amount of job security, but men (62%) are more likely than women (52%) to say they have opportunities for growth and advancement. Majorities across racial/ethnic groups report having access to educational or training assistance, advancement opportunities, and at least a fair amount of job security, with the exception of Latinos—only 43 percent say their current job provides educational or training assistance. The shares reporting growth opportunities, educational or training assistance, and job security increase with rising educational attainment. The shares who say they have growth opportunities and at least a fair amount of job security rises as income levels increase, while the share reporting educational or training assistance varies across income groups, but is higher among those making $40,000 or more. Employed adults with an income of less than $40,000 are the least likely across all demographic groups to say their current job offers any of these benefits.

About eight in ten adults completely (42%) or somewhat agree (40%) that it is important for workers to organize so that employers do not take advantage of them, and a similar share agree at least somewhat that voting gives people like them a say in what the government does (38% completely, 43% somewhat). Views were similar last November. There is agreement among partisan groups on both issues, although Democrats are more likely than Republicans and independents to completely agree. Overwhelming majorities across regions and demographic groups agree with both statements, but Asian Americans and whites are much less likely than African Americans and Latinos to completely agree that it is important for workers to organize, while African Americans are somewhat more likely than members of other racial/ethnic groups to completely agree that voting gives people a say in government. The share completely agreeing that it is important for workers to organize declines as age increases.

Policies to Increase Economic Well-Being

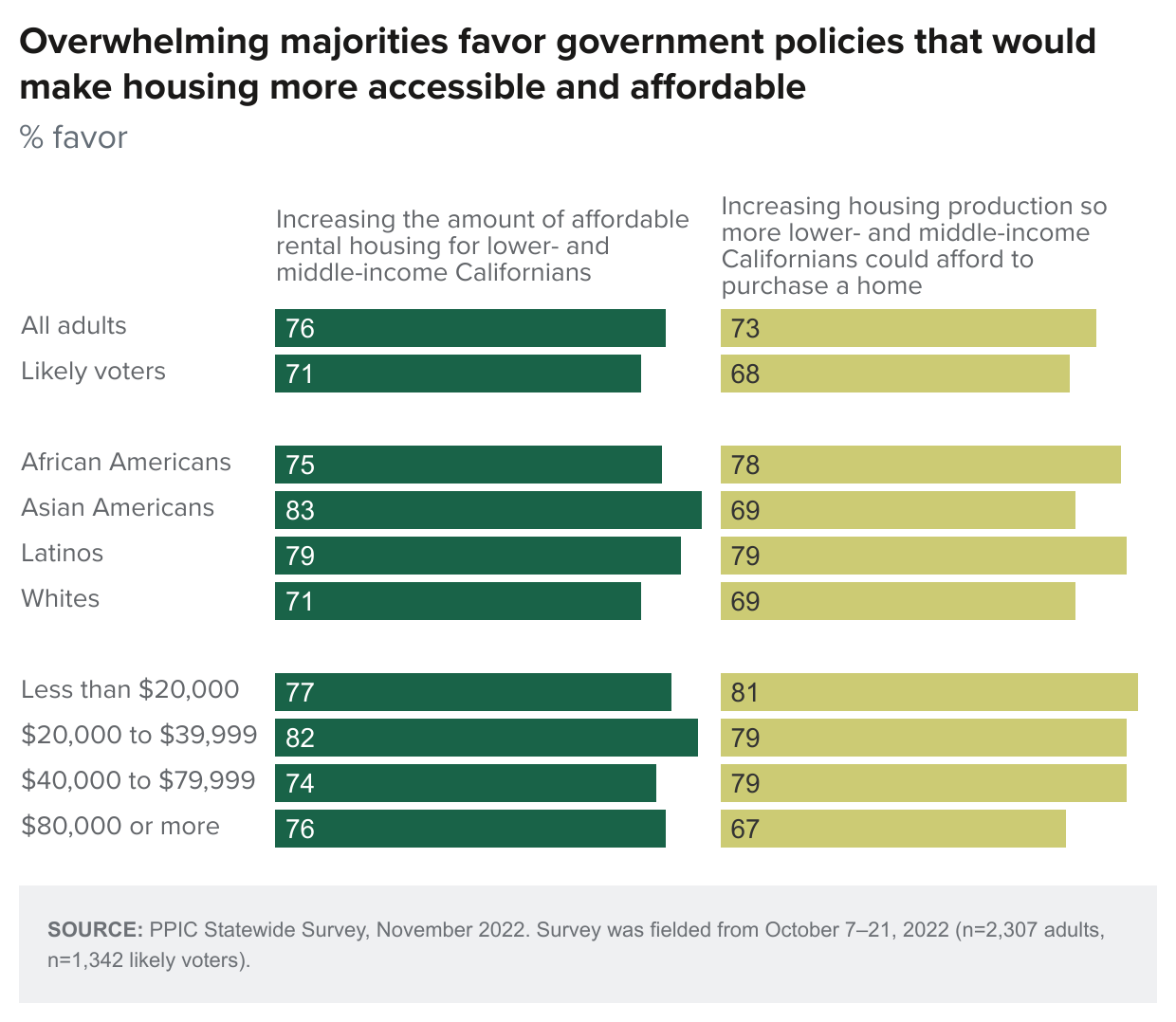

With California among the top five states with the highest average home prices, strong majorities of adults (73%) and likely voters (68%) favor government policies that would ease permit requirements and allow more housing to be built so that lower- and middle-income Californians could afford to purchase a home. Similar shares (76% adults, 71% likely voters) support government policies intended to increase the amount of affordable rental housing for lower- and middle-income Californians. Most adults across regions support these policies, as do majorities across all partisan and demographic groups.

California currently has the highest gasoline prices in the country, averaging $5.56 per gallon as of October 31, 2022. Majorities of adults (61%) and likely voters (53%) favor increasing government funding so that more Californians could afford to purchase an electric or hybrid vehicle. Most across regions as well as most partisan and demographic groups are supportive—the exceptions are Republicans (22% favor, 78% oppose), those with some college education (50% favor, 50% oppose), and whites (47% favor, 53% oppose).

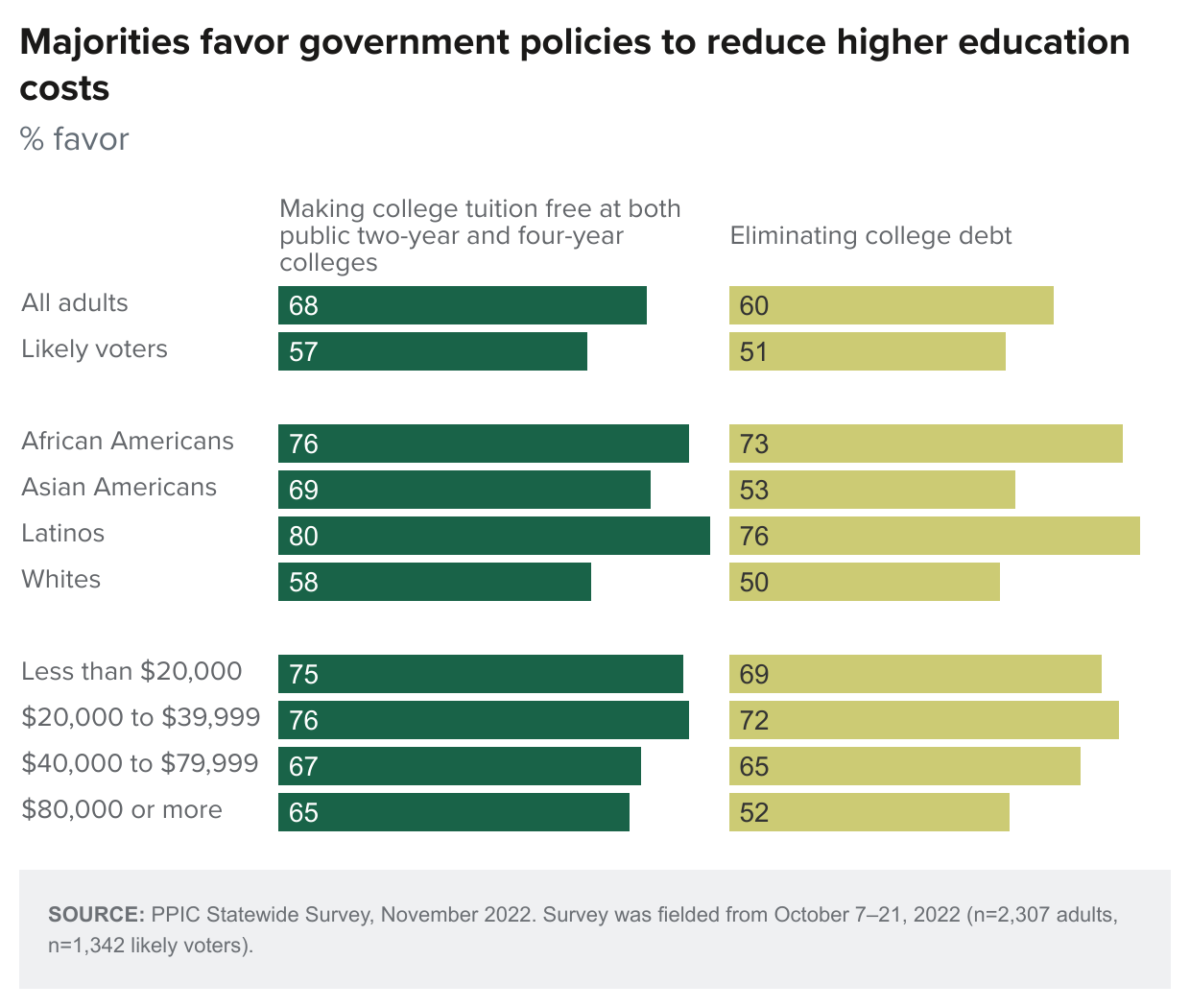

When asked about policy proposals to address the cost of higher education, majorities of Californians (68% adults, 57% likely voters) support a government policy to make college tuition free at both public two-year and four-year colleges, and about half or more (60% adults, 51% likely voters) support a government policy that would eliminate college debt. Similar shares held these views 12 months ago. Overwhelming majorities of Democrats support these policies, while most Republicans oppose them; a solid majority of independents support free tuition at public universities but are divided on eliminating college debt. Majorities across regions and demographic groups favor free college tuition, while half or more support eliminating college debt. Support for these policies is lowest among whites and adults ages 55 and older.

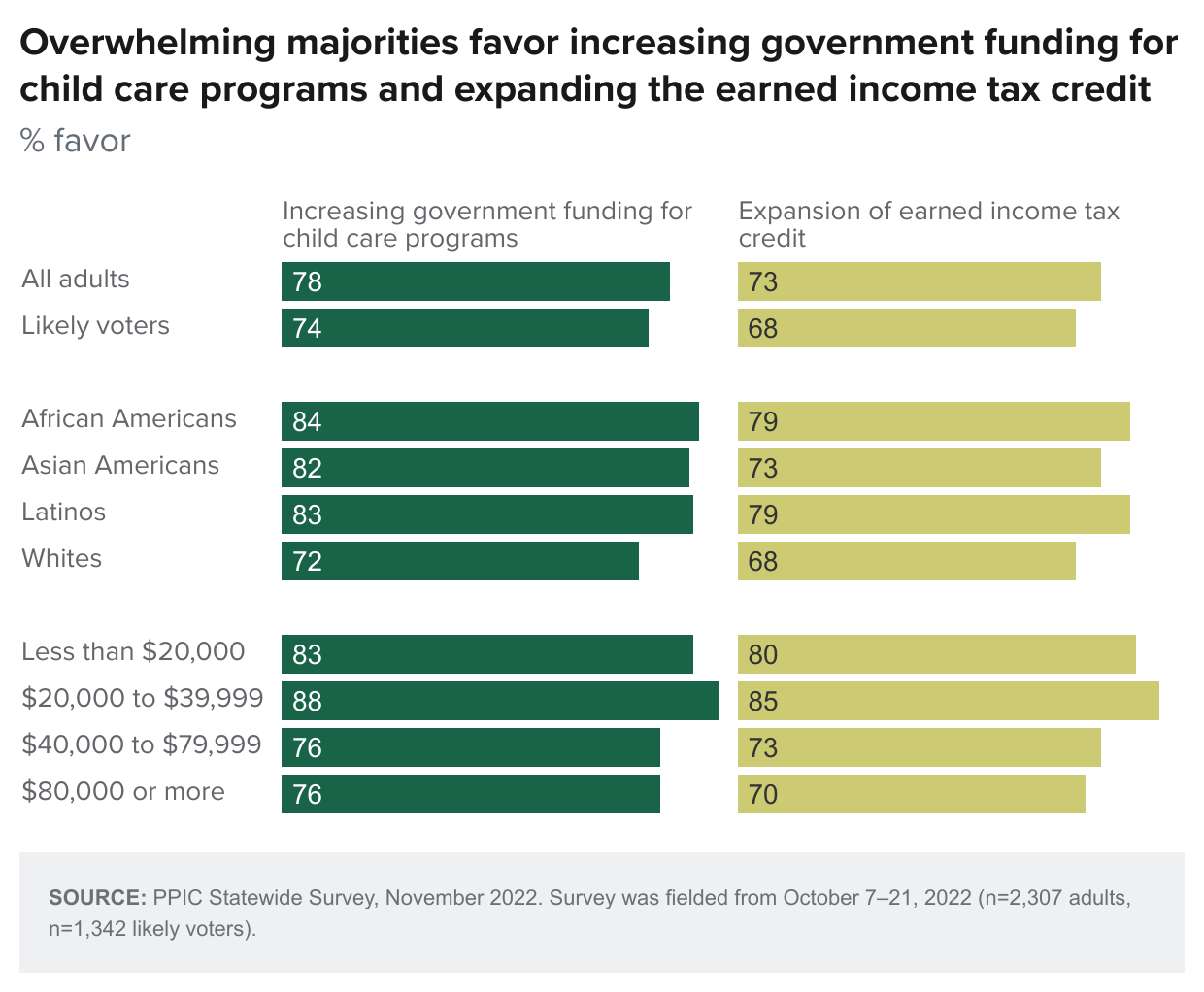

Most adults (73%) and likely voters (68%) are in favor of expanding earned income tax credits for lower-income working Californians. When asked about increasing government funding so that child care programs are available for more lower-income working parents, overwhelming majorities of adults (78%) and likely voters (74%) express support. Overwhelming majorities of Democrats and independents support increased funding for child care programs and the expansion of earned income tax credits; a slim majority of Republicans oppose both. Strong majorities across regions and demographic groups favor both these policies, although whites are less likely than adults in other racial/ethnic groups to support more funding for child care programs. Adults earning more than $40,000 annually are less likely than lower-income Californians to favor these policies.

About half of adults (48%) and four in ten likely voters favor the federal government providing a guaranteed income or “universal basic income” of about $1,000 a month for all citizens, whether they work or not. A slim majority of adults (52%) and six in ten likely voters oppose this policy. Views were similar last November. Support is much higher among those earning less than $40,000 (72% less than $20,000, 61% $20,000 to $39,999) than those with higher incomes (46% $40,000 to $79,999, 41% $80,000 or more). Democrats (62%) are much more likely than independents (45%) and Republicans (13%) to support this policy. There is majority support among 18- to 34-year-olds (62%) and those with a high school diploma or less (53%) compared to other age and education groups. African Americans (60%), Latinos (60%), and Asian Americans (54%) are much more likely than whites (36%) to support a universal basic income policy. Californians across regions are closely divided on this idea.

Eight in ten adults (82%) and likely voters (80%) are in favor of increasing government funding for job training programs. More than seven in ten (80% adults, 73% likely voters) support the government offering a health insurance plan similar to Medicare that Americans could purchase instead of private insurance. Similar shares favored these policies last November. Majorities across partisan groups favor increasing funding for job training programs, and half or more support a government health insurance plan. Overwhelming majorities across the regions and demographic groups support these policies, though whites are much less likely than adults in other racial/ethnic groups to favor a public health insurance option.

Topics

COVID-19 Economy Health & Safety Net Housing Political Landscape Poverty & Inequality Statewide SurveyLearn More

A Regional Look at the Availability of Well-Paying Jobs after COVID

Californians Are Pessimistic about Economic Times Ahead

Fewer Californians Say Racism Is a Big Problem Today Compared to 2020

How Is Remote Work Affecting Worker Preferences and the Economy?

Video: Californians and Their Economic Well-Being

Voters’ Wish List for the Next Election Cycle