California added 73,000 jobs between mid-May and mid-June, in the month leading up to the state’s June 15 reopening. This gain was lower than the gains in each of the previous four months, and California’s annual rate of growth is slightly lower than the national rate (5.2%, compared to 5.7% in the US overall). But the growth of both jobs and wages, especially in the leisure and hospitality sector, indicates that some hard-hit California workers are benefitting from the recovery.

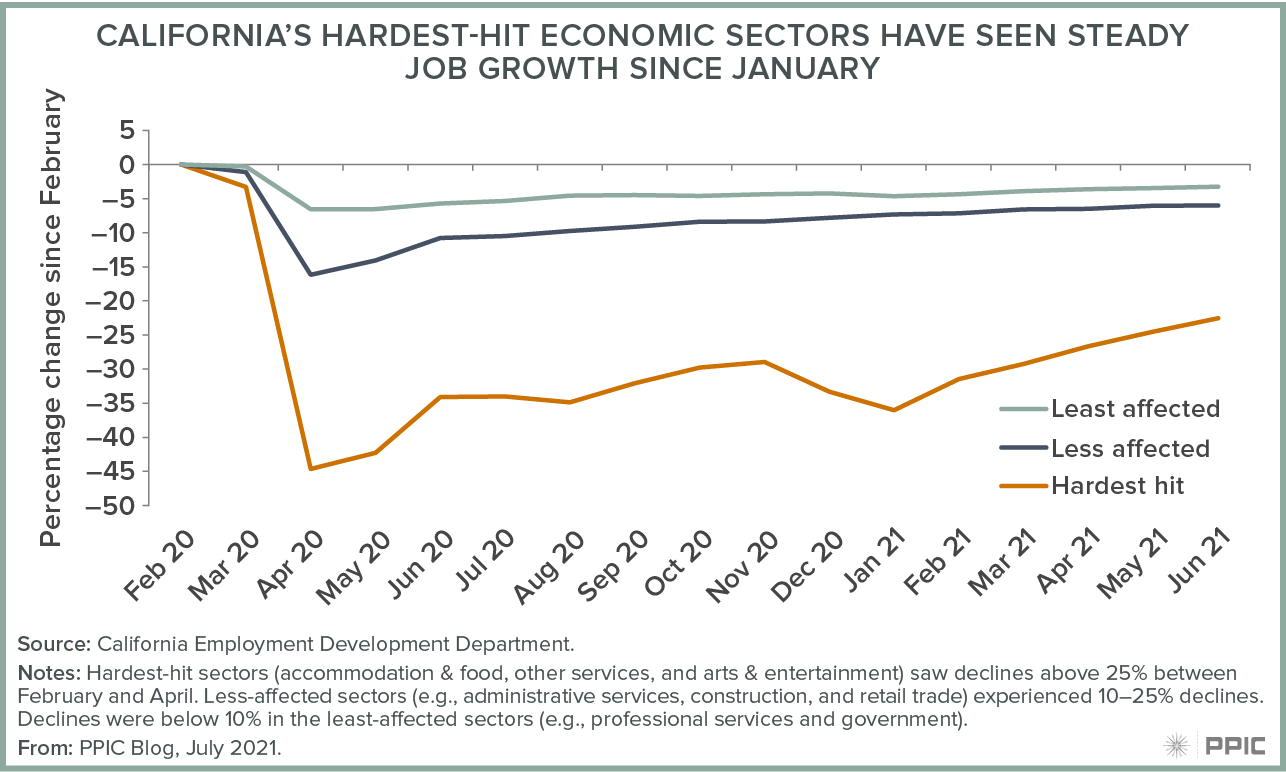

Most job growth last month (70%) and this year (64%) occurred in the leisure and hospitality and other services sectors, which were hit hardest during the pandemic. Employment in these sectors has been growing more quickly than in any other sector, but remains down 22.5% (or 597,000 jobs). As they did last month, health care and government sectors saw the next-largest job gains (more than 7,000 each).

California’s June 15 reopening was expected to accelerate gains in the hardest-hit sectors. However, according to Burning Glass data, California job postings in leisure and hospitality peaked in early June at about 150% of the year before, and Indeed.com job postings in hospitality and tourism lagged behind other sectors in in terms of growth relative to pre-pandemic. California’s hardest-hit sectors may be buoyed by increased tourism. But reemerging concerns about COVID-19 and the delta variant—which prompted LA county to reinstate a mask mandate—could limit these gains.

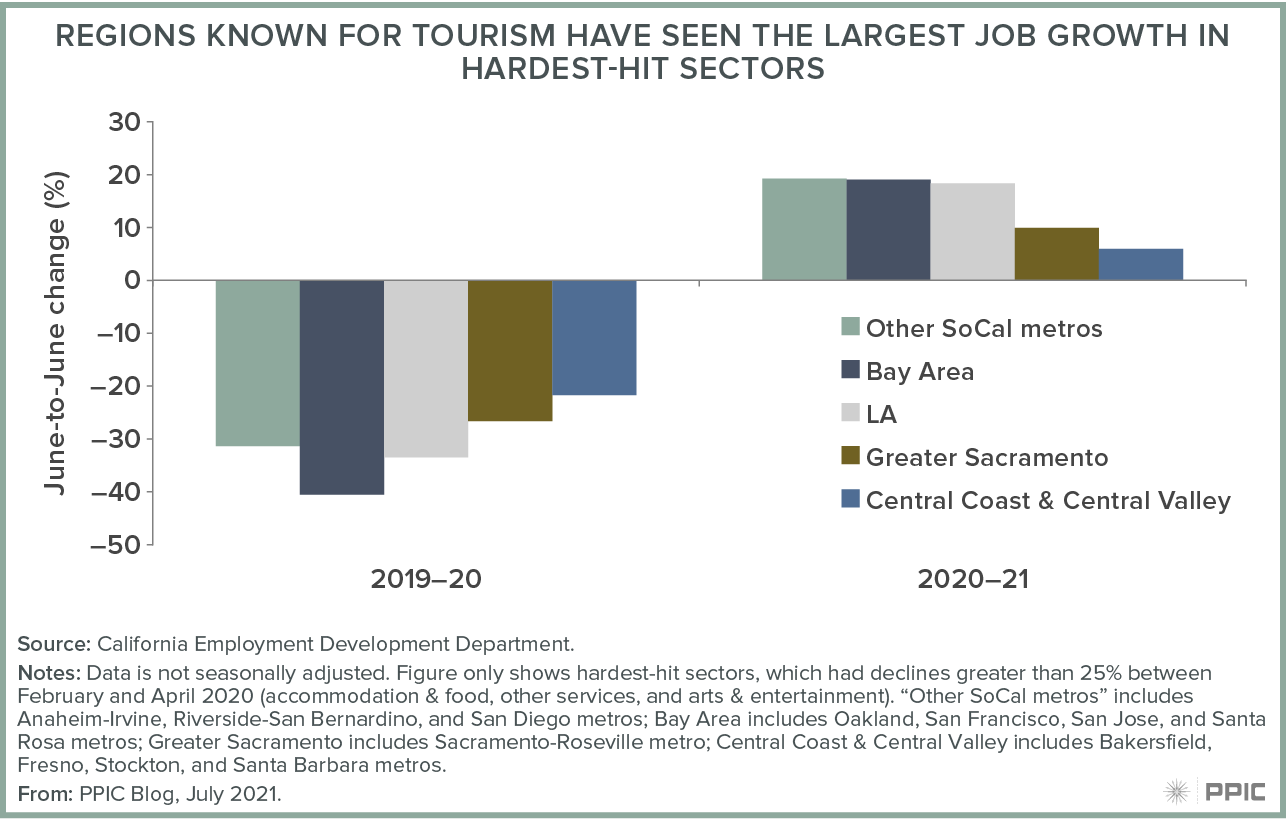

Hardest-hit sectors saw the strongest employment growth in regions of the state that experienced the largest declines last year, such as Southern California and the Bay Area. Job growth in hardest-hit sectors within these regions (18–19%) exceeded the statewide rate between June 2020 and June 2021. These regions have the deepest hole to climb out of: jobs in these sectors are down more than 30% compared to June 2019.

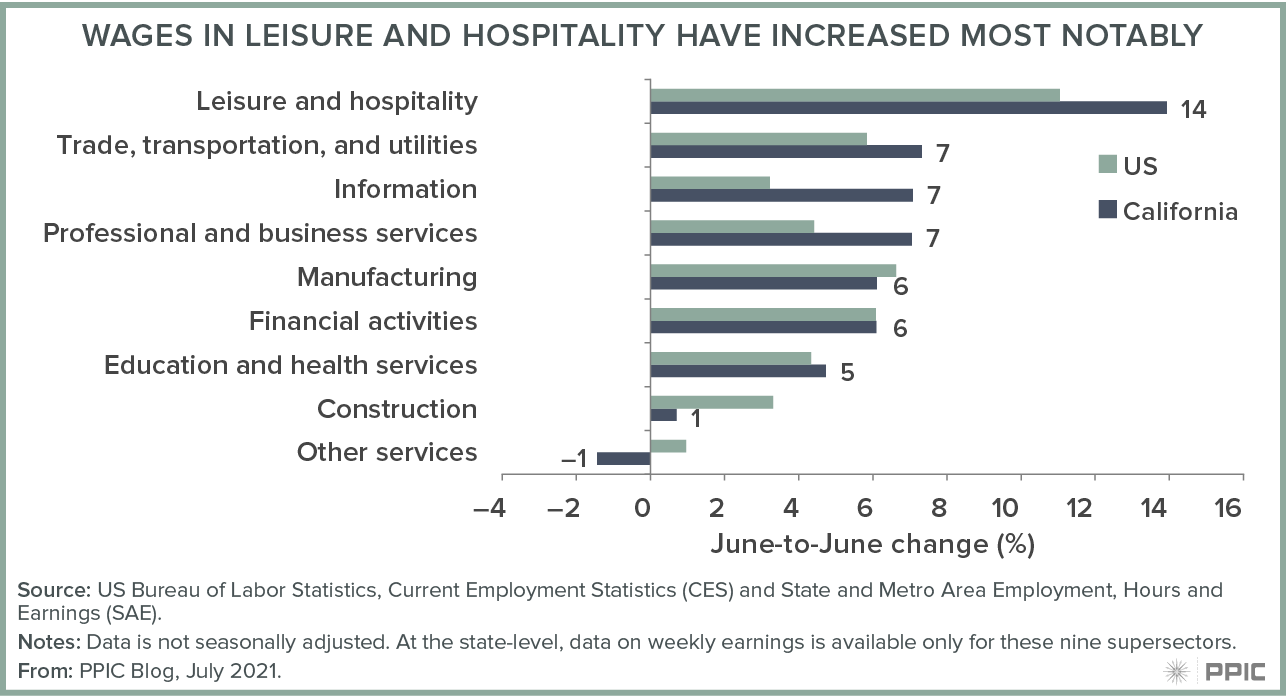

While job growth is a critical indicator of California’s recovery, hours and wages matter for business costs and worker well-being. In the leisure and hospitality sector, weekly wages are up 14% in California compared to one year ago; this is the largest annual increase in any sector. However, wages in this sector are still far lower than those in any other sector: on average, leisure and hospitality workers make $604 per week; the next-lowest sectorwide wage is $990 per week, in other services.

Wage growth in leisure and hospitality likely reflects increased competition for available workers (aka worker shortages); these increases may be temporary—caused by slow labor market reentry, or attributable to workers holding out for higher wages, facing challenges with dependent care, or feeling continued concerns about the safety of face-to-face jobs. But wage increases may be permanent if they reflect worker transitions to new sectors, productivity increases (due to, for instance, investments in technology during the pandemic), or compositional changes in the type of workers businesses have been hiring (or have retained) since last year.

These factors will affect how the recovery unfolds over the coming months. While job growth in the most impacted sectors is a sign of economic recovery, earnings will tell a more complete story about whether this recovery affects inequality in the labor market